eToro is one of the best places to buy stocks online – not least because the broker offers thousands of US and international shares at 0% commission. Moreover, through its fractional share tool – you can buy stocks from just $10.

In this guide, we show you how to buy stocks on eToro in under five minutes from start to finish.

How to Buy Stocks on eToro – Quick Guide

We’ll start this beginners’ guide on how to trade stocks on eToro with a quick step-by-step walkthrough of the basics.

- ✅ Step 1: Open an eToro Account – Before you can buy stocks on eToro, you will need to register an account with the broker. Click on ‘Join Now’ and fill in the registration form. This requires some personal and contact details, as well as a choice of username and password.

- 💳 Step 2: Deposit Funds – For US clients, the minimum first-time deposit at eToro stands at a very affordable $10. Best all, not only can you choose between a debit/credit card, bank transfer, or e-wallet for this purpose – but no deposit fees are charged to US clients.

- 🔎 Step 3: Search for Stock – eToro is home to thousands of US and international stocks. As such, it’s best to find your preferred stock by typing in the name of the company into the search box. When the stock appears, click ‘Trade’.

- 🛒 Step 4: Buy Stock – You will now see an order box. You simply need to decide how much money you wish to invest in the stock (from $10) and then click on the ‘Open Trade’ button to confirm the order.

And that’s it – you have just learned how to buy stocks on eToro at 0% commission. Read on for a more detailed walkthrough of the investment process with the best stock trading platform – eToro.

How to Buy Stocks with eToro – Tutorial

If this is your first time using the eToro platform, we’ll show you how to buy stocks in a simplified way. This covers everything from the best cannabis stocks to the best dividend stocks.

This tutorial includes the steps required to register an account, verify your identity, deposit funds, search for a stock, and finally – place a buy order.

Step 1: Open an eToro Account

The first step – as is the case with all online stock brokers, is to open an account with eToro. After clicking on the ‘Join Now’ button, you will see a registration form like in the image below.

This will require you to choose a username and password for your account login credentials. You will also need to enter your email address.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

After clicking on ‘Create Account‘, you will be asked for some additional personal information. This includes your first and last name, nationality, residential address, and date of birth.

You also need to enter your cell phone number. In doing so, eToro will send a unique code via SMS to your phone – which you will then need to enter to complete the registration process.

Step 2: KYC Process

The Know Your Customer (KYC) process is deployed by all stockbrokers that are regulated to operate in the US. Put simply, it’s a way for brokers like eToro to verify your identity and thus – remain compliant with laws surrounding money laundering.

eToro requires two documents for you.

First, to prove your identity, you will need to upload one of the following three documents:

- Passport

- State ID Card

- Driver’s License

Your chosen identity document must still be valid.

Second, to prove your stated residential address, you will need to upload one of the following documents.

- Statement issued by your bank or credit card company

- Utility bill issued by an electricity, water, or gas company

- Tax letter or bill

- Letter from your local municipality

Other documents are also accepted. With that said, the proof of address document that you upload must have been issued within the last three months.

Once you have uploaded the two required documents, eToro is usually able to verify your identity near-instantly.

Step 3: Deposit Funds

One of the best things about choosing to buy stocks on eToro is that US clients can deposit and withdraw funds fee-free. This is the case across all of the payment methods supported by eToro – of which there are many.

First, you will need to enter the amount of money that you wish to deposit – from $10 upwards. Make sure that you select ‘USD’ from the currency tab.

Next, from the drop-down box, select the payment method that you wish to use.

Your options include a debit/credit card issued by Visa, MasterCard, or Maestro. E-wallets like Paypal and Neteller are also supported. You can also choose from online banking, ACH, and a bank wire.

Step 4: Search for Stock

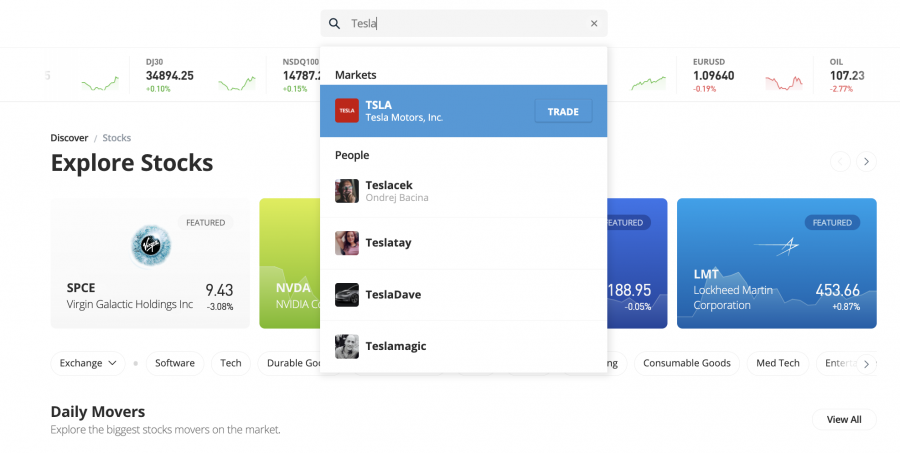

At this stage, you should have funds in your newly created eToro account. Now it’s time to search for the stock that you want to buy. The easiest way to do this is to type the name of the company into the search bar at the top of the screen.

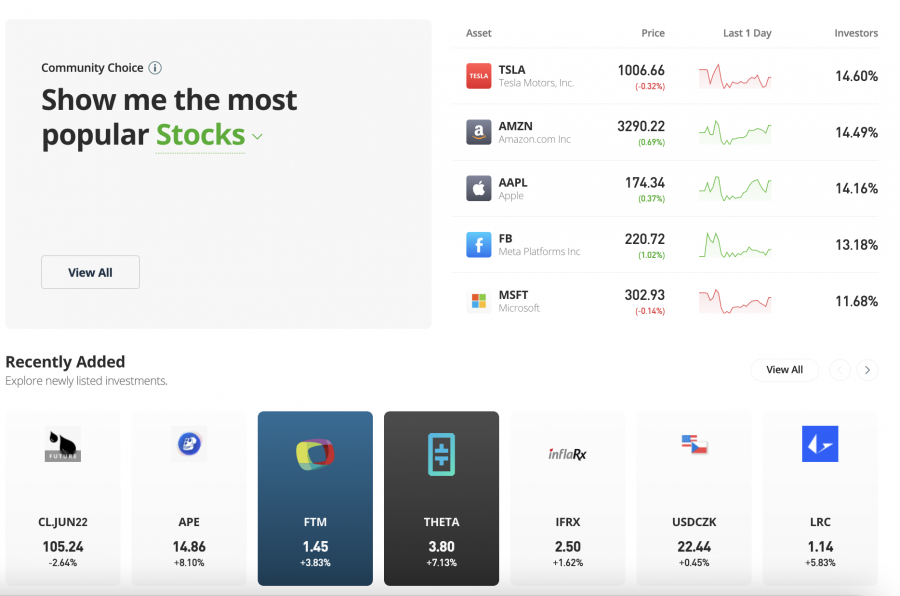

As you can see from our example below, we are looking to buy Tesla stocks. Furthermore, there are so many options to browse through, from the best oil stocks to the best tech stocks.

The other option is to click on ‘Discover’. After clicking on ‘Stocks’, you can then navigate through the many thousands of shares offered by eToro.

You can, for example, narrow down your search based on the respective sector – such as energy, software, tech, or retail.

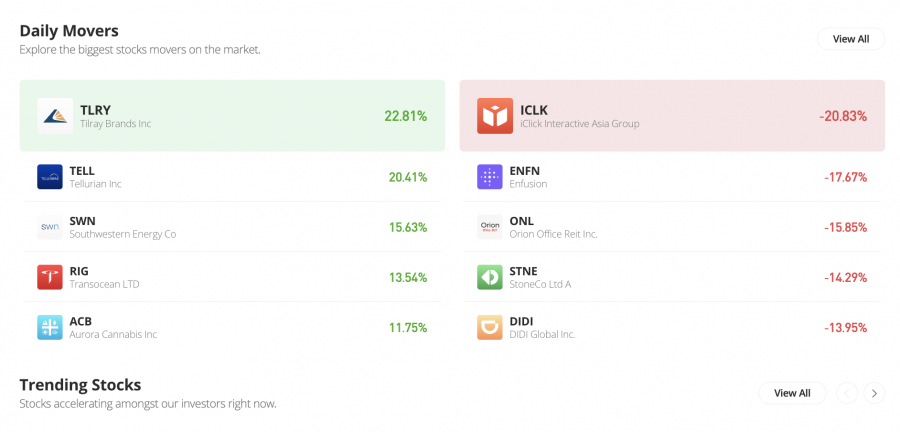

Alternatively, you can check out the daily market mover section. This shows you the best and worst-performing stocks within the prior 24 hours and thus – can be a great way to find trending companies.

Step 5: Research and Analysis

If you simply want to buy stocks on eToro – you can proceed by clicking on the ‘Trade’ button to load up an order form. However, it’s also worth noting that you will also have access to a wide variety of market data for your chosen stock. This includes the best blockchain stocks.

As such, it’s a good idea to do a bit of analysis before you place your order. Not only does this include comprehensive charts and pricing tools, but up-to-date news.

Step 6: Create Buy Order to Buy Stock

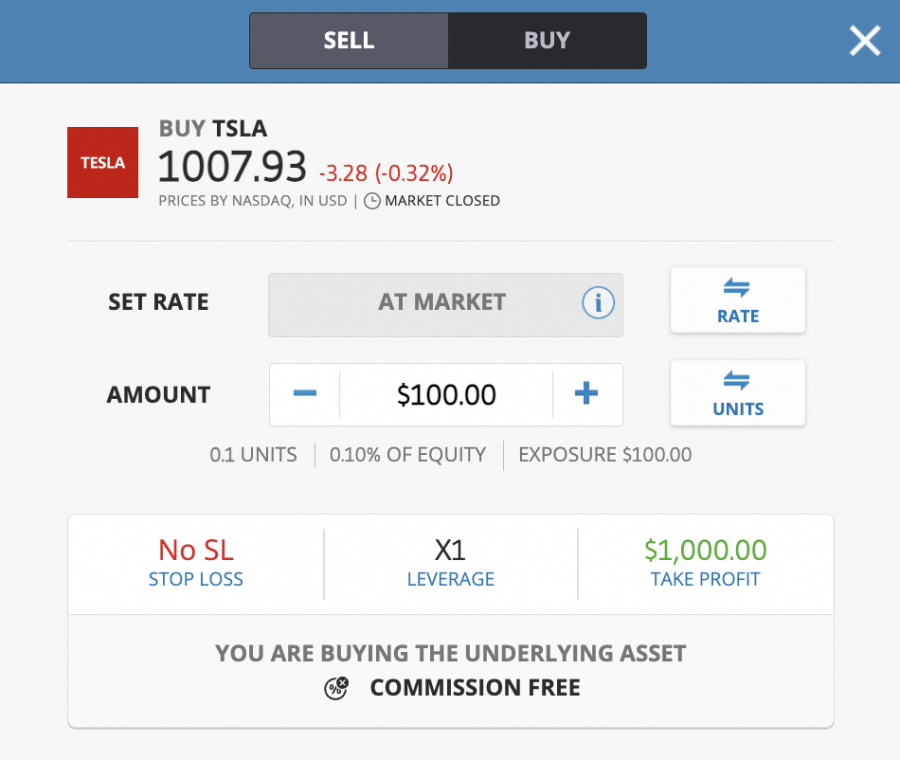

The final part of the process is to place a buy order. As noted above, to load up an order box for your chosen stock – click on the ‘Trade’ button.

Now, depending on your financial goals, eToro gives you several options when it comes to placing buy orders.

If you simply want to buy your chosen stock at the next best available price – all you need to do is specify your stake in the ‘Amount’ box and click on ‘Open Trade’.

In doing so, eToro will instantly execute your order. If the markets are closed, you will instead need to click on ‘Set Order’ and the position will be executed when the markets reopen.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

With that said, some of you might be looking to buy stocks on eToro at a specific entry price. For example, in the image above, you will notice that at the time of the order, Tesla stocks are priced at $1007.93 per share.

As per your own research, you might only want to buy Tesla stock when it drops to a share price of $950. In this case, all you need to do is click on the ‘Rate’ button and enter the price that you want your stock order placed.

Next, you might also consider clicking on the ‘Stop Loss’ button. This allows you to set a price that your stock order should be closed – should it decline in value by a specified amount.

Finally, you can also click on the ‘Take Profit’ button to lock in a price target. For instance, you might want eToro to close your stock trade when it gains in value by 30%.

Irrespective of your chosen strategy, once your eToro stock order is executed – the shares will be added to your portfolio.

How to Sell Stock on eToro

eToro allows you to sell your stocks with ease at any given time – as long as the markets are open.

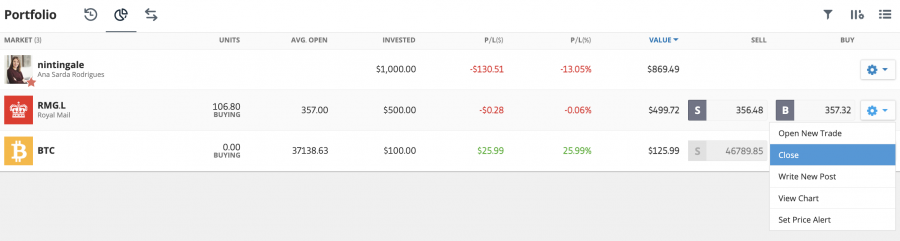

If you’re wondering how to sell stock on eToro – you will first need to click on the ‘Portfolio’ button – which you will find on the left side of the screen. You will then be presented with a list of assets that you have previously invested in.

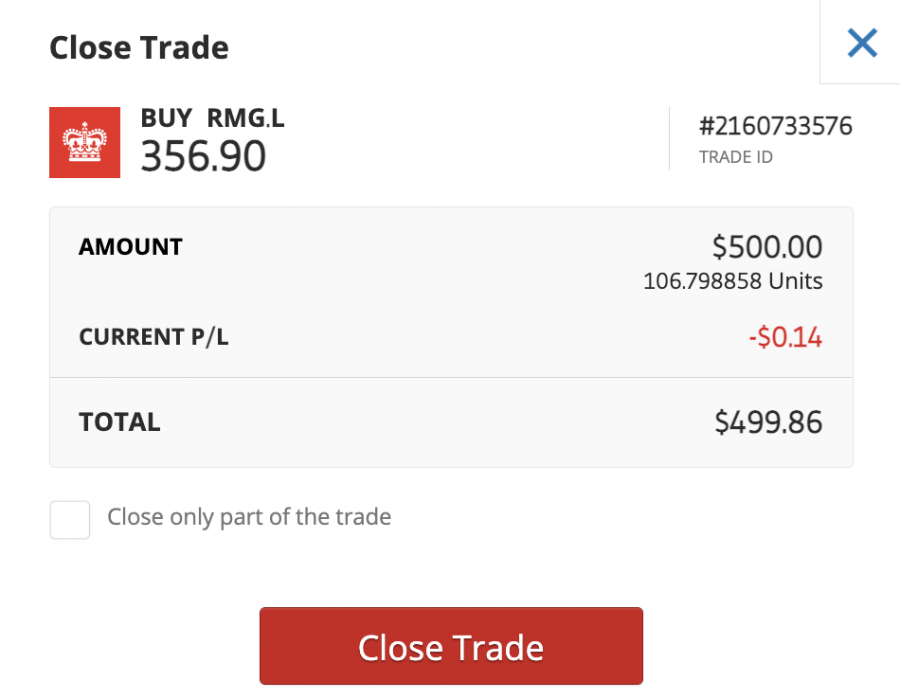

As our Tesla order has not yet been filled, we’ll use our previously executed Royal Mail stock position in this example.

Next, click on the ‘Settings’ button located next to the stock you wish to sell, followed by ‘Close’.

Finally, a sell order box will appear. To cash out your stocks on eToro – click on the ‘Close’ button.

If the markets are open, the stock will be sold at the next best available price and the proceeds will be added to your cash balance – which you can then withdraw.

How Much Does it Cost to Buy Stocks on eToro?

When you buy stocks online, there are generally three fees to take into account:

- Deposit fees

- Commissions

- Spreads

We’ll break down these fees so that you know exactly what you are paying when you buy stocks on eToro.

eToro Deposit Fees

If you are based in the US, you will not pay any deposit fees. This is the case across all supported payment methods.

eToro Commission

Alongside dozens of other online brokers, eToro allows you to buy US-listed stocks without paying any trading commission. This is also the case when you sell your US-listed stocks.

However, where eToro really stands out is that is you can also buy international stocks and the best penny stocks on a commission-free basis. This isn’t something that other US-based brokers like Robinhood, Webull, or Zacks Trade can rival.

- For example, let’s suppose that you were to buy shares listed on the London Stock Exchange at Zacks Trade.

- In doing so, you would pay a commission of 0.3% per slide – at a minimum of £12.

- This means that buying £5,000 worth of Royal Mail stocks would cost you a commission of £13.

- If you then sold your Royal Mail stocks when they were worth £7,000 – this would cost you a commission of £21.

- As such, in total, you paid commissions of £34 on this international stock trade.

If you were to buy stocks on eToro and replicate the exact same conditions as above – you would not pay a single penny in commission – even though you are investing in a foreign-listed company.

eToro Spreads

The spread is a fee that many newbie investors are unaware of. It’s essentially the percentage gap between the bid and ask price of the stock you want to buy – and this can and will vary considerably depending on your chosen exchange.

We found that generally, spreads at eToro are very tight.

For example, at the time of writing, eToro is quoting us the following on Tesla stocks:

- Bid Price: $1007.93

- Ask Price: $1006.66

Although the above figures might not mean anything to you at first glance, we can tell you that this equates to a spread of just 0.126%. And as such, this is very competitive.

eToro Stocks Review

If you’re not sure whether eToro is the right broker for you – here we explain why the platform is now being used by over 20 million clients. First and foremost, eToro offers a huge library of stocks that run into the thousands. In the US, this covers stocks listed on both the NASDAQ and NYSE.

In addition to US stocks, you can also invest in companies listed overseas. This covers over a dozen exchanges from a variety of regions – including but not limited to the UK, Germany, France, Spain, Greece, Canada, Saudi Arabia, and Hong Kong. Did you know that eToro offers some of the best metaverse stocks to invest in right now such as Nvidia and Roblox Corp?

Best of all, eToro offers its 0% commission and tight spread policy on both US and international stock markets. As noted earlier, this isn’t something that other US brokers can rival. We also like the fact that eToro offers zero-fee deposits and withdrawals on USD payments.

While we are on the subject of payments, eToro supports e-wallets like Neteller and Paypal, ACH, online banking, and debit or credit cards. The minimum deposit to open an account with eToro is just $10. Moreover, when you buy stocks on eToro, you only need to risk $10 per trade – which is great for high-value companies like Berkshire Hathaway, Google, and Tesla.

Once you have bought a selection of stocks on eToro, you might also consider adding some commission-free ETFs to your portfolio – of which there are many. You can also buy cryptocurrency like Bitcoin, Dogecoin, Shiba Inu, and Ethereum at eToro at super-low fees.

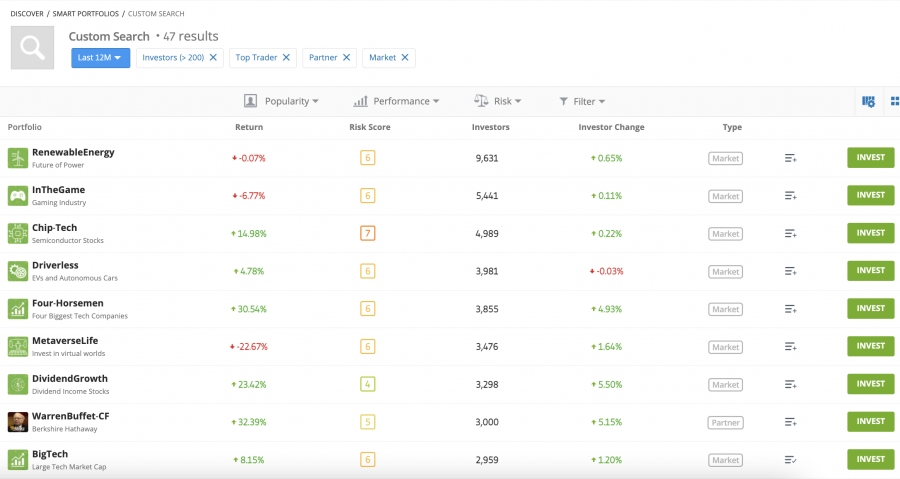

Perhaps the overall standout feature of using eToro is that it offers a due of passive investment tools – both of which come without additional fees. First, you have the copy trading feature – which, as the name implies, allows you to copy other eToro investors. Any stocks that your chosen trader buys and sells will be replicated in your own account.

This means that you can actively trade stocks without needing to do any market analysis or place any orders. The second tool to consider is the eToro smart portfolio service. Across dozens of strategies, this allows you to invest in specific industries. For instance, you can invest in a managed portfolio that tracks companies involved in chip-tech, driverless cars, or renewable energy.

Another reason to buy stocks on eToro is that the brokerage firm is regulated by a number of tier-one bodies. On top of being approved in the US, eToro is also licensed by the FCA (UK), CySEC (Cyprus), and ASIC (Australia). And finally, eToro enables you to invest in stocks via its active mobile app – which has been dubbed one of the best stock apps on the market in 2022.

| Number of Stocks | 3,000+ |

| Deposit Fee | FREE |

| Fee to Buy Amazon Stock | No Commissions |

| Minimum Stock Trade Size | $10 |

What We Like:

- Thousands of US and foreign stocks

- Minimum deposit is only $10

- Fractional shares supported – all of which are commission-free

- Regulated by numerous top-tier entities

- Accepts credit/debit cards and PayPal deposits

- User-friendly trading app

- No fees on USD deposits and withdrawals

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

This guide has explained how easy it is to buy stocks on eToro. Not only does this top-rated brokerage make the investment process simple – but you’ll be able to buy stocks listed in the US and overseas without paying any commission.

We also like that eToro appeals to casual investors on a budget – as the minimum stock trade requirement is just $10. And finally, getting started with an eToro stock trading account takes less than five minutes – and no fees are charged on USD deposits.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Frequently Asked Questions on Stock Exchanges

Can you buy stocks from eToro in the US?

How can I buy Stocks on eToro?

Is eToro good for buying stocks?

Source link