The cruise ship industry had a miraculous turnaround coming out of the COVID-19 pandemic. After completely shutting down and losing loads of money for multiple quarters, cruise ship demand exploded with vacationers hitting the high seas on these vast floating hotels. Two publicly traded cruise ship stocks are Royal Caribbean(NYSE: RCL) and Carnival(NYSE: CCL). Since the beginning of 2021, both of these companies have seen revenue explode higher. In fact, Royal Caribbean stock is now up 100% in the last 12 months.

What is the better buy right now: Royal Caribbean or Carnival? Time to pit these two cruise lines against each other and see which — if either — is a good buy for investors today.

Carnival: Most passengers carried

The largest cruise ship company in the world by passengers carried is Carnival. Owner of its namesake brand as well as the Holland and Princess cruise lines, the company carried a whopping 3.9 million passengers last quarter, up from 3.6 million a year ago.

Revenue over the last 12 months was $24.5 billion. Coming out of the pandemic, Carnival has flexed its profit muscles, generating an operating margin of 14% over the last 12 months. This equates to $3.4 billion in earnings for the company in the last year.

Over the rest of this decade, analysts expect revenue for the cruise industry to grow by around 5% per year. If Carnival can maintain its market share, this sector tailwind will lead to growing sales and hopefully expanding profit margins. In turn, this will lead to more earnings growth for shareholders. Today, you can buy shares of Carnival at a price-to-earnings ratio (P/E) of 16, which is well below the S&P 500 index average of 30.

Royal Caribbean: Best profit margins

The second-largest player in cruises is Royal Caribbean, which offers a more premium experience for customers. In the quarter ending in June, just over 2 million passengers were carried on its boats. Over the last 12 months, revenue came in at $15.3 billion, which is up significantly from revenue during the doldrums of the COVID-19 pandemic.

Royal Caribbean generates less revenue than Carnival, but it actually has significantly higher profit margins (24% operating margins over the last 12 months). These high profit margins mean Royal Caribbean generates $3.68 billion in annual operating earnings. This is more than Carnival over the past 12 months.

In fact, Royal Caribbean has around double the market cap of Carnival, sitting at $46 billion as of this writing. Its stock has outperformed Carnival over the past year, generating strong 106% returns vs. 41.5% for Carnival due to better management of the income statement.

However, the stock has a higher P/E than Carnival, at 19.6. Investors should take this into consideration before loading up on shares.

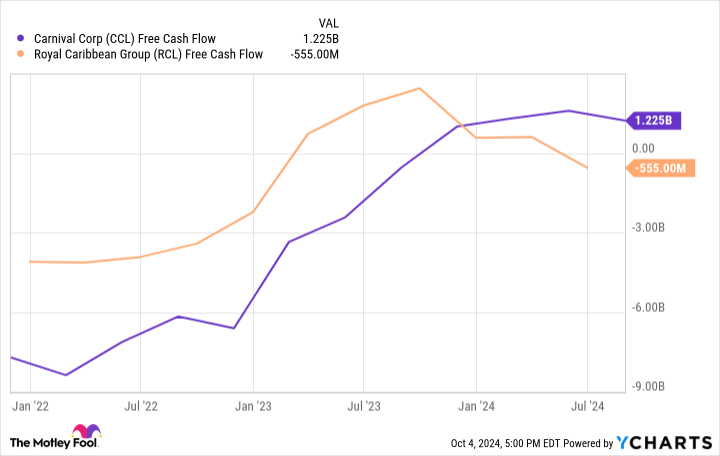

CCL Free Cash Flow data by YCharts

The case for neither

At first glance, both Royal Caribbean and Carnival Corp look like attractive stocks. They both are benefiting from long-term sector tailwinds, are the leading players in the cruise industry, and have solid profit margins. But we are forgetting two things about these businesses: cash flow and debt. Both are a huge negative for these cruise ship operators.

First, both companies generate inconsistent cash flow due to the huge capital expenditures needed to run a cruise ship business. These are large ships; they aren’t cheap to build and operate. In fact, Royal Caribbean’s free cash flow was negative over the past 12 months. Carnival’s was positive $1.23 billion but still well below its stated operating earnings.

A headwind to cash flow is the huge debt both of these companies carry on their respective balance sheets. Royal Caribbean has over $20 billion in debt and close to zero cash. Carnival has close to $30 billion in debt and $1.5 billion in cash. Historically, these cruise ship operators have struggled to generate healthy cash flows, and it is hard to see how they will pay back these debts unless the business model changes.

Taking this into consideration, neither of these stocks is a buy. You simply don’t buy stocks that have debt bombs on the balance sheet waiting to go off. Smart investors don’t do this. If consumer spending turns south, there could be a lot of downside for these equities. Just look at what happened in 2020.

Should you invest $1,000 in Royal Caribbean Cruises right now?

Before you buy stock in Royal Caribbean Cruises, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Royal Caribbean Cruises wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

Source link