* UK ramps up no-deal preparations as EU trade talks stall

* German exports rise in July but remain below pre-crisis

levels

* Technology leads sectoral declines, defensives rise

* French electricity giant EDF sinks as output falls

Sept 8 (Reuters) – European shares fell on Tuesday on fears

that the UK was in danger of leaving the European Union without

a trade agreement, while technology firms tumbled as their U.S.

peers looked set to deepen a selloff from last week.

The pan-European STOXX 600 fell 0.4%, shortly after opening

marginally higher, as technology stocks weighed the most

with a 1.7% fall.

The focus now shifts to Wall Street returning from a long

weekend, following news that Softbank made big option

purchases during the run-up in the U.S. stock market, with the

trades being revealed just as a tech-led rally faltered.

“(Wall Street) did stabilise and recover soon after the

Friday open but this will be the first full trading session

where specific news of the recent fevered options market

activity has been fully revealed to the market. So it’s a big

session today,” said Jim Reid, strategist at Deutsche Bank.

Futures tracking the Nasdaq 100 index fell 1.3% in

early trading.

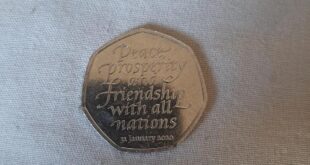

Adding to the downbeat tone, Britain began a fresh round of

Brexit trade talks this week by warning the European Union that

it was ramping up preparations to leave the bloc without an

agreement as the two sides bicker over rules that govern nearly

$1 trillion in trade.

Analysts at Commerzbank urged caution against completely

excluding a scenario where negotiations fail.

“This is the result of the typical prisoner’s dilemma: for

fear of getting short shrift, an agreement is then reached that

is disadvantageous for both sides but the ‘devil may care’

approach demonstrated by the British government does not exactly

help to instil confidence.”

Frankfurt shares fell the least among peers after

data showed German exports rose in July but remained far below

their pre-crisis level.

Defensive sector indexes, including real estate as

well as food and beverages, were among the few making

gains in early trading.

French electricity giant EDF sank 6.5% after

announcing its nuclear output fell 17.6% in August due to the

effects of the pandemic and reactor outages.

Britain’s Royal Mail jumped 15% after raising its

revenue target for the current year.

The European Central Bank’s (ECB) policy decision is on the

roster for Thursday, with the bank expected to keep its policy

stance unchanged. Investors will focus on the ECB’s inflation

forecasts and whether it seems concerned by the euro’s recent

strength.

Markets also await second-quarter GDP data for the euro zone

later in the day, with economists polled by Reuters expecting a

12.1% quarter-over-quarter decline.

(Reporting by Shreyashi Sanyal in Bengaluru; editing by Patrick

Graham and Devika Syamnath)

Source link