The Royal Mail (OTCPK:ROYMY, OTCPK:ROYMF) has rallied significantly over the past week, over 30%, on news of growth in the company’s parcel business. The company has made a few other operational updates, but overall, the story hasn’t changed much. The dividend remains suspended and will likely be reinstated at a much lower level and significant restructuring is still needed before the company’s core UK segment is profitable again.

Image Source

The Good News

In the Royal Mail’s AGM trading update, they showed an improvement on parcel volume. The company now expects a 25% year over year increase in domestic parcel revenue, versus 15% expected. International parcel volume also improved from an expected YOY decline of 3% for the year to a 10% improvement. Their GLS segment saw a similar trend, with revenue growth expected at 10-14% year over year. This trend is a significant boost in the rise of e-commerce and parcel demand, which will likely spur some long-term shifts in consumer behavior to online purchases, which supports the Royal Mail’s goal of growing their parcel service to offset declining letter demand.

Furthermore, the company’s expected impact negative impact from COVID-19 has improved by £20 million, but remains a downward pressure on profit of £(120)m. The company plans to offset this downward pressure with a £130 million cost through a management restructure, which will be annualized beginning in fiscal year 2021-2022. They are also looking to save £200 million in non-people costs to make their costs flat for FY2021-22 versus FY 2019-20. The company also has seen a significant bump in profitability at GLS, similar to what we have seen at other parcel-focused delivery companies like DHL or FedEx.

The Bad News

The company still sees significant negative impacts from the cost of COVID-19. The cost of the shift to more parcel volume from letters also is expected to incur a £140-60 million cost for the company, as parcel service, though growing and potentially more attractive long-term, remains expensive due to hand-sorting costs among other service expenses.

This leads in to the second ongoing concern for many investors: union negotiations. The company’s union discussions are ongoing and have yet to be concluded. The company is very vague, only saying that they have made “good progress.” This – coupled with management’s inability to give solid guidance – adds a level of uncertainty and risk, especially if union talks were to stall or a profitable agreement is not reached.

While GLS is seeing a bump in profit, the same cannot be said for the Royal Mail proper. This main company segment is expected to post a material loss for the year and “will not become profitable without substantial business change.” That is not a sentence that is a cause for any comfort, especially in a company who recently suspended its dividend.

Dividend

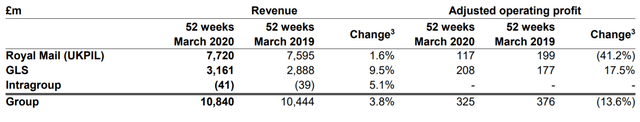

Looking back at the company’s annual report, we see that as a result of a sharp drop-off in Royal Mail (UKPIL) profit, and in spite of revenue growth, GLS is now the leading segment for the group’s operating profit.

Recognizing this and allowing for perhaps a 10% YOY climb in GLS profit, we can see the impact from a material loss making UKPIL. With an overly generous drop in operating profit to a flat 0 pounds, and an average £40m loss from Intragroup, we have an annual operating profit for the group of £188.8. This is approximately the same as the previous year drop in UKPIL alone – 41.9% for the whole group. Granted, the loss from the UKPIL segment is forecast to be negative rather than neutral, exacerbating the impact on group profitability.

The company maintains its intention to pay no dividend this fiscal year, but revive its payments in 2021-22, with profitability from GLS to support it. Given the significant drop in overall group profitability since 2019, and the prospect of an unprofitable UKPIL for some time, I have no expectation for the company to restart its dividend at the same level as prior to the cut.

The company’s payout ratio has historically remained below 50%, although it climbed substantially in its last year of payment. Considering this, an expected significant drop in profit, and potentially substantial restructuring costs despite cost saving measures – the company’s new payout is likely to drop significantly as well. Giving the company a 20% lower profit for this period, we get a forecasted payout at around 5p per share. This would be a 40% payout on 12.88p in earnings per share. This would be well below previous yields, which had held fairly steady around 5% for several years, offering a 2.14% yield at current prices. And once again, the actual numbers may be quite different, and likely worse.

Valuation

The company is currently valued at a trailing price to earnings ratio of 14.91, which is well below that of its peer, the Deutsche Post, with a P/E of 22.74. However, the Royal Mail is expected to be loss-making this year, unlike DP, and has larger structural issues they have yet to deal with. The company’s recent 30% spike seems unwarranted, and the shares slightly overvalued, as they are up 6.6% YOY despite materially worse conditions.

Conclusion

The Royal Mail has a long way to go before they become an attractive investment again. The company has the potential to become a great investment, but it currently faces too many core issues with a key incentive for investment, the dividend, absent and unlikely to return with the same force. The company’s increase in parcel revenue is more than offset by related costs, which is a large risk if they are unable to reach a union agreement. Until more issues are tied up, or shares become significantly cheaper, remain wary Royal Mail shares.

Author’s Note: If you enjoyed this article and found it useful, please consider hitting the orange “Follow” button up above to be notified when I publish new content and leave a like down below if you would like more content covering the Royal Mail and other delivery companies.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes only and should not be regarded as investment advice. This article should not be the sole basis for a financial decision, including the purchase or sale of stock. Any personal financial decision should be made on the basis of your own research and consideration of your unique financial goals and investing ideals.