Image source: Getty Images

Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Aviva

Aviva (LSE: AV) is a British multinational insurance company. It has millions of customers across its core markets. Aviva is also the UK’s largest general insurer. This week, an influential director purchased shares through the firm’s Global Matching Share Plan.

- Name: Jason Storah

- Position of director: Chief Executive Director

- Nature of transaction: Partnership shares and matching shares

- Date of transaction: 15 July 2022

- Amount bought: 38.413602 @ £3.93

- Amount received: 76.827204 @ £3.93

- Total value: £452.70

Royal Mail

Royal Mail (LSE: RMG) is Britain’s biggest postal service and courier company. The group runs the brands Royal Mail and GLS. It released its Q1 trading update this week. Two director dealings also occurred.

- Name: Mick Jeavons

- Position of director: Chief Financial Officer

- Nature of transaction: Free shares (Deferred Share Bonus Plan 2019)

- Date of transaction: 18 July 2022

- Amount bought: 14,132 @ nil

- Total value: £N/A

- Name: Katherine Amsden

- Position of director: PCA of Mark Amsden, Group General Counsel and Company Secretary

- Nature of transaction: Purchase of shares

- Date of transaction: 21 July 2022

- Amount bought: 34,262 @ £2.92

- Total value: £99,977.21

Deliveroo

Deliveroo (LSE: ROO) is a British online food delivery company. It operates in over 200 locations across the UK and internationally. In the UK, it is the second-biggest food delivery platform. In this week’s transaction, a director exercised their option to redeem stock compensation.

- Name: Adam Miller

- Position of director: Chief Financial Officer

- Nature of transaction: Free shares

- Date of transaction: 15 July 2022

- Amount received: 83,400 @ £0.85

- Total value: £70,973.40

- Name: Adam Miller

- Position of director: Chief Financial Officer

- Nature of transaction: Sales of shares to cover tax liabilities

- Date of transaction: 15 July 2022

- Amount sold: 40,407 @ £0.85

- Total value: £34,345.95

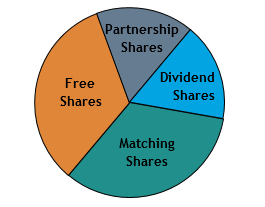

Types of shares in a SIP

To provide context, there are a few types of shares within a company’s share incentive plan (SIP). A SIP is an employee plan for companies within the UK to flexibly award equity to employees. Publicly listed companies normally use this option because it’s tax-efficient for both the employer and its employees.

In this week’s director dealings, Aviva’s CEO opted to purchase partnership shares. Partnership shares give employees the opportunity to buy shares via deductions from their salary, before tax deductions. But where partnership shares are offered, the company can also offer matching shares. This can range up to a maximum ratio of two free matching shares per partnership share purchased, as was the case. That being said, it’s important to note that matching shares must normally be held in a trust for at least three years, and held for five years in order to receive full tax relief. However, these shares may be forfeited if an employee withdraws their partnership shares from the trust.

On the other hand, the Royal Mail CFO received free shares. This occurred under the company’s Deferred Share Bonus Plan from 2019. Having said that, the director is expected to retain their share-based awards until they achieve an equivalent of 200% of their salary.

As for Deliveroo’s CFO, he received free shares. These are a form of restrictive stock units (RSU). RSUs are a form of stock compensation. It is a promise from the company to award a company’s shares in the future. RSUs are most often used in younger companies. This is because cash on its balance sheet is used to grow the business instead.