Shorted with over 19 million shares and almost 2x the ratio compared to GameStop (NYSE:GME), RGC is still trading 300% above IPO price. While its Game-On for RGC’s CEO, he continues to buy back…

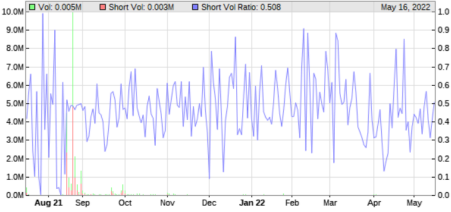

RGC Short Interest

Regencell Bioscience Limited’s (NASDAQ:RGC) stock is an undiscovered short squeeze potential. The short volume ratio has similar pattern as that of GameStop Corp. (NYSE:GME), whereby both averaged over 40% in the past year. In fact, RGC is more heavily shorted than GME as some days were close to 90% shorted.

Q1 2022 hedge fund letters, conferences and more

Bridgewater On Investors’ Number One Mistake

Over the years, Bridgewater’s “Daily Observations” research notes have built a reputation for their unparalleled and informative views on the macro economy. But Bridgewater’s research notes aren’t just focused on economic trends. Occasionally, the firm publishes a document that covers investment strategy. In 2004 (revised during 2006) the group published a “Daily Observations” note titled, Read More

Over the years, Bridgewater’s “Daily Observations” research notes have built a reputation for their unparalleled and informative views on the macro economy. But Bridgewater’s research notes aren’t just focused on economic trends. Occasionally, the firm publishes a document that covers investment strategy. In 2004 (revised during 2006) the group published a “Daily Observations” note titled, Read More

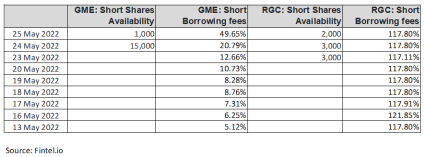

Source: shortvolume.com

However, as much as RGC and GME stock’s short volume profile is similar, not much is known about the facts and figures of RGC, which is provided below. As of 16 May 2022, RGC’s founder and CEO holds 10,539,159 ordinary shares, representing 81.0% of the total number of issued and outstanding ordinary shares in RGC. RGC’s total cumulative short volume as reported by third party data analytics provider is over 19 million shares and RGC’s total reported short volume to outstanding shares (excluding CEO and Chairman ownership ratio) is over 7 times, which is almost double that of GME. Where are all the extra shares coming from?

For the Period 16 July 2021 to 16 May 2022 GME RGC Exchange Short Volume(i) 111,133,100 6,734,997

FINRA Short Volume(ii) 159,893,282 12,625,757

Total Reported Short Volume 271,026,382 19,360,754

Total Outstanding Shares 75,958,469 13,012,866

Chairman & CEO Holdings(iii) 10,369,462 10,539,159

Outstanding Shares Excluding CEO & Chairman 65,589,007 2,473,707

4.13 7.83

Sources:

Total Reported Short Volume / Outstanding Shares Excluding CEO & Chairman

(i) FINRA data from https://stocksera.pythonanywhere.com/

(ii) Exchange data from Futubull

(iii) Insiders (CEO and Former CEO) data from the latest schedule 14A and 13D filings

“Too often, sophisticated hedge funds have used short selling and complex derivatives to take advantage of small investors. They will short a company, conduct a negative publicity campaign to drive the stock price down temporarily and cash out, then do it all over again many times. The term for this, as you may be aware, is ‘short & distort,’” Elon Musk wrote in his email exchange to CNBC.

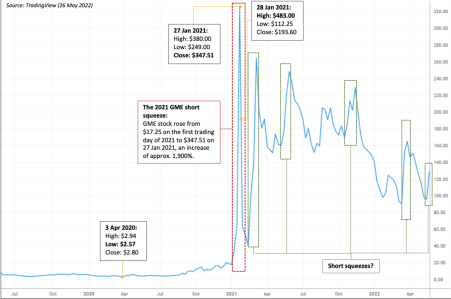

As witnessed on Reddit and other social media and forums, especially during the GME short squeeze, retail shareholders came together, driven by the community’s effort to punish market participants who make a living shorting and distorting public companies, causing them to stumble and fall.

GME’s 3-year historical stock chart, net loss and net cash position at its financial year ended 2019 to 2022 are as follows:-

| Financial year ended | Net Profit/(Loss) ($ million) | Net cash ($ million) |

| 30 January 2019 | (673) | 803.6 |

| 30 January 2020 | (470.9) | 79.6 |

| 30 January 2021 | (215.3) | 145.8 |

| 30 January 2022 | (381.3) | 1,226.80 |

Source: Capital IQ

A short squeeze on GME created a return of 51x (current price to its historical low) to 191x (historical high to its historical low), what is the potential for RGC if there is a short squeeze?

Founder & CEO’s Conviction Of A Better And Brighter Future

When insiders (and in the case of RGC, its CEO) have consistently bought shares of the company, it demonstrates their confidence and belief in the company.

Since the listing of RGC on Nasdaq on 16 July 2021, RGC’s CEO has purchased over $5 million of ordinary shares and has not sold any shares. Such percentage of shareholding also gives confidence to investors and potential investors alike as it is apparent the CEO is confident about the future of the company.

The CEO is literally putting his money where his mouth is and he will continue to use his personal funds to purchase company shares to demonstrate his commitment and confidence to the Company and his position against short and distort sellers. To date, the CEO:-

- Has personally funded the company and did not pay himself back after IPO;

- RGC’s CEO has continuously funded the Company since its incorporation up to the IPO without bank borrowing.

- He converted his shareholders’ loan of $3.25 million to RGC’s ordinary shares upon listing.

- Is a listed company CEO who does not draw a salary and bonus; and

- Pledged to not draw salary and bonus of more than US$1 until the Company reaches US$1 billion market capitalisation.

- Reserved share options for all employees except himself.

- Has showed consistent support.

- Of the 6,296 US-listed companies in 1Q 2022 (as published by Statista) and with reference to CEO share purchases data available on MarketBeat.com, RGC’s CEO is probably the only CEO who does not draw a salary and bonus, reserved share options for all employees except himself and had continuously purchased more than $5 million worth of his company’s shares.

Short sellers may not have noticed or have overlooked this important shareholder composition. The company is backed by strong shareholders, e.g., Samuel Chen and Fiona Chang, directors and shareholders of Digital Mobile Ventures Ltd.

Samuel Chen was very successful alongside Li Ka-shing from his early investment in Zoom. He owned 8.8% of the total voting power in Zoom post-IPO and Zoom’s market capitalization peaked at US$161 billion on 19 October 2020.

Based on Schedule 13G filing with the SEC on 15 December 2021, Digital Mobile Ventures Ltd. is the second largest shareholder in RGC, holding approximately 7.63% of the total outstanding shares.

Recent News

Following the announcement on 16 February 2022 of its investigational liquid-formula RGC-COV19TM showing effectiveness in eliminating mild to moderate COVID-19 symptoms within a 6-day treatment

period through the Company’s EARTH efficacy trial, the Company has recently announced on 18 May 2022 that its additional efficacy trial corroborated the data of the first efficacy trial. In delivering natural treatment that are safe and effective, the company is clearly in the right direction to save and improve lives of patients, which result in a positive impact and benefit to the people around them as well.

The company also recently announced that all directors and employees who were previously granted stock options upon the Company’s IPO have agreed to a further lock-up undertaking for a period of six months after their stock options become vested; as their stock options are set to vest on 16 July 2022, their shares will remain locked up until 16 January 2023.

Recession-Resistant Stock

When the economy heads toward a recession, it is natural for investors to worry about falling stock prices and its impact on their portfolios, and look towards recession-resistant stocks. During economic downturn like what we are experiencing now, smart money rotates into sectors that are less sensitive to the economic cycle, like healthcare, which have historically fared well during recessions. The simple reason is that health is always a priority and nothing else is more important.

RGC CEO is a strong shareholder and will continue to invest in the company with the goal of saving and improving the lives of patients, especially children.

Philanthropic project – helping people in need.

Regencell Foundation is a private philanthropic foundation established by RGC’s CEO in 2017. He is currently spearheading a philanthropic project to provide grants to over 10,000 children afflicted with ADHD, ASD, COVID-19 and those in severe financial conditions. RGC’s CEO started providing grants on 16 April 2022 and has helped over 150 children. Interested persons may see the company’s links below.

DISCLAIMER: This paid advertisement. This is not a solicitation for the purchase or sale of securities. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice, prior to making any investment decision. Advertisements and sponsorships are provided as a service to ValueWalk users . ValueWalk is not responsible for their content, services or products. The statements and opinions contained in this advertisement are not those of ValueWalk, and ValueWalk disclaims any liability for or arising from such statements and opinions. You are hereby advised that ValueWalk is receiving a fee as compensation for the distribution of this advertisement.

https://www.regencellbioscience.com/regencell-foundation/

https://www.regencellbioscience.com/cash-donation-to-over-150-children-in-the-philippines during-covid-19/

https://www.regencellbioscience.com/cash-donation-to-over-10000-children-afflicted-with-adhd asd-covid-19-and-those-in-severe-financial-distress/

Updated on

Source link