Tories win general election

After Boris Johnson’s Conservative party won a landslide majority the likes of which has not been since Margaret Thatcher, industry professionals have hailed the news as a tailwind for the UK economy and assets.

The markets reacted positively to the win, with the domestically-facing FTSE 250 rising 4% in morning trading and the FTSE 100 up 1.5% amid relief that a Corbyn-led Government has been avoided.

Nigel Green, chief executive and founder of deVere Group, said: “Boris Johnson’s election gamble has paid off. Christmas has come early for the pound, the British economy and UK financial assets.”

The results are particularly good news for areas of the market that would have been re-nationalised under labour, such as transport companies and the Royal Mail. The latter is up by 5% at 244p, while transport companies such as Go-Ahead and Stagecoach are trading 10% and 13% higher, respectively.

Sterling spikes on Conservative majority

The prospect of a stronger UK economy has also pushed up shares in banks, housebuilders, leisure companies and retailers, with Taylor Wimpey, Persimmon and Royal Bank of Scotland topping the FTSE 100 list of risers with share jumps of around 12% each.

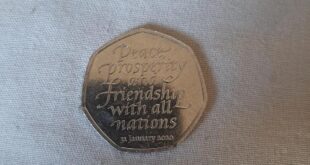

Russ Mould, investment director at AJ Bell, said: “The fact that there also won’t be a hung parliament has given support to equities. The market now has more confidence that Johnson should be able to pass a Brexit deal and for the UK to formally leave the EU at the end of January 2020.”

Marcus Brookes, CIO at Schroders Personal Wealth, expects demand for equities to rise, leading to further stock gains, while he sees investors shunning safe-haven government bonds.

However, he said: “The more internationally focused company shares that dominate the FTSE 100 index, might have gains limited. The rise in the value of the pound would make the prices of such companies’ goods and services more expensive to overseas buyers.”

Back to Brexit

James Dowey, of Liontrust’s global equity team, said the election outcome was the best for the markets, but “nevertheless, not a silver bullet”.

“This is a significant step forward in the overall Brexit process, which is clearly holding back the UK economy. As such, in the near term, UK assets should benefit and economic growth accelerate,” he said.

However, he added that “while a way forward has at last been found, it is one that will very likely incur significant long-term economic costs so the bounce back will likely be limited in size and short-lived”.

“For example, sterling may find it difficult to get much beyond the mid-1.30s range against the dollar,” he said.

Tories win landslide majority in ‘disappointing’ election for Labour

Mould agrees that the uncertainty surrounding Brexit has not been removed, “so today’s market fanfare may not necessarily be setting the tone for how all of 2020 will play out”.

“Markets hate uncertainty and ultimately Brexit will become centre-stage again,” he said.

“Investors have been served a distraction in the form of the General Election in recent weeks but the focus will now have to shift back to the structure of any trade deal and what could happen to the UK at the end of the 2020 transition period.”

Green added the self-imposed end of December 2020 deadline is “a mammoth challenge”, meaning a no-deal Brexit could still be on the cards on 1 January 2021. Aneeka Gupta, associate director for research at WisdomTree, expects the Government to request an extension to this deadline, despite pledging not to do so.

The Scotland issue

Commentators are also concerned that the overwhelming support for the Scottish National Party (SNP), which won 48 seats, will lead to renewed calls for Scottish independence.

Green said: “The election result also puts a question mark over Scotland’s future in the United Kingdom. The SNP’s gains will embolden them in their key aim of securing Scottish independence.

“Mr Johnson’s monumental task to deliver Brexit with a deal and the Scotland issue will continue to fuel uncertainty in 2020.”

Source link