Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I’ll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I’ll share a recap of the articles you may have missed from the previous month.

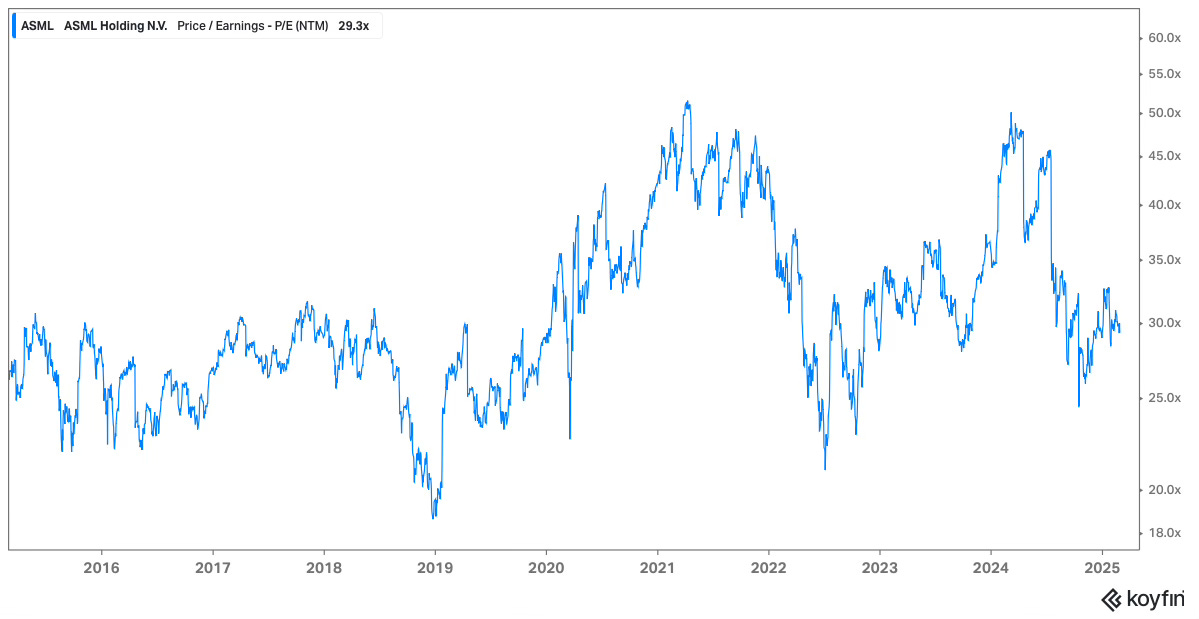

ASML (ASML)

I opened a position in ASML, a stock that has been on my watchlist for almost two years. Since the news of DeepSeek broke in January, I have been conducting extensive research into the area of semiconductors and AI. For better or worse, I realised that I have little to no direct exposure to AI, with only indirect exposure via the hyperscalers and Meta. This was intentional, as I did not feel comfortable investing in Nvidia and similar companies due to their complexity. This is where ASML comes in. It sits at the beginning of the value chain, developing and manufacturing machines used to produce semiconductor chips. If Nvidia and others are chasing the gold rush, then ASML is selling the shovels.

As you can see in the excellent chart above from

, ASML’s customers are the foundries such as TSMC and Samsung. ASML has a monopoly in EUV lithography machines, and for good reason. The complexity of these machines is such that more than 100,000 components are sourced from specialty providers. The average price of an ASML machine is close to €400 million.

What I find attractive about ASML at the moment is that it has not seen the explosion in earnings and revenues that other AI stocks like Nvidia have. Revenue only grew by 3% in 2024, but this is because it is a cyclical business. As ASML comes out of this trough, revenue is expected to grow by double digits over the next couple of years as the first modules of its TwinScan EXE:5200 will be delivered to customers. Intel has already received the first two cutting-edge lithography machines from ASML, which are now in production at its factories. Early results showed that the machines can do what previously took three exposures and about 40 processing steps with just one exposure and a single-digit number of processing steps.

Last year, TSMC began construction of its first €10 billion semiconductor plant in Germany, expected to be operational by 2027. This plant will need machines supplied by ASML.

Finally, ASML is not just an AI play. Its business is diversified well beyond this area, as semiconductor chips are in everything from household appliances to smartphones and electric vehicles. At 29 times forward earnings, I think this is a reasonable valuation for a business that could grow earnings at a compounded annual growth rate of close to 20% over the next three to five years.

Uber (UBER)

Uber reported strong Q4 earnings earlier this month, yet the stock sold off by 8%. While I don’t spend much time trying to predict market behaviour, this reaction really puzzled me. I initiated this position in December, and while it had already provided double-digit returns, it was still quite small, so I used this opportunity to add to my position. The very next day, the stock recovered and soared even higher as Bill Ackman disclosed that he had accumulated a $2 billion position. This was another great example of the importance of doing your own objective work rather than reacting to short-term price movements.

The full earnings review is linked below.

Uber: Record User Engagement

PayPal (PYPL)

I decided to sell my full position in PayPal, worth 1% of my portfolio, after it reported Q4 earnings. PayPal is in a tough spot at the moment and is in turnaround mode with a new CEO at the helm. When the stock was trading below $60 in 2024, I had even considered adding to the position. In hindsight, I probably should have sold when the stock hit $90, as this was always a turnaround play despite owning the stock for several years.

Personally, I see no reason to own PayPal over a business like Adyen, other than comparative valuations. Cheap is not always better, and cheap stocks are often cheap for a reason. Adyen is continuing to thrive, while PayPal’s Braintree has completely ground to a halt, only growing 2% in Q4. While overall revenue grew 7%, a large-cap business growing revenue and earnings at low single digits is not where I want to allocate capital when there are so many better opportunities out there.

What made this decision easier was the fact that this position represented only 1% of my portfolio, and I am looking to consolidate my holdings. If I wasn’t prepared to increase my weight, there was little point in holding such an immaterial position.

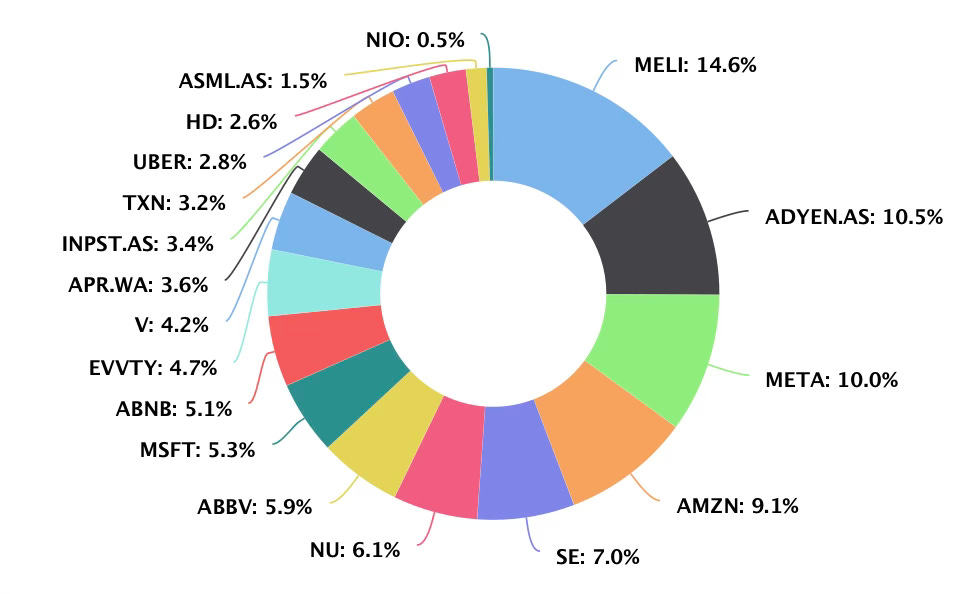

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

Stocks on my radar to add this month:

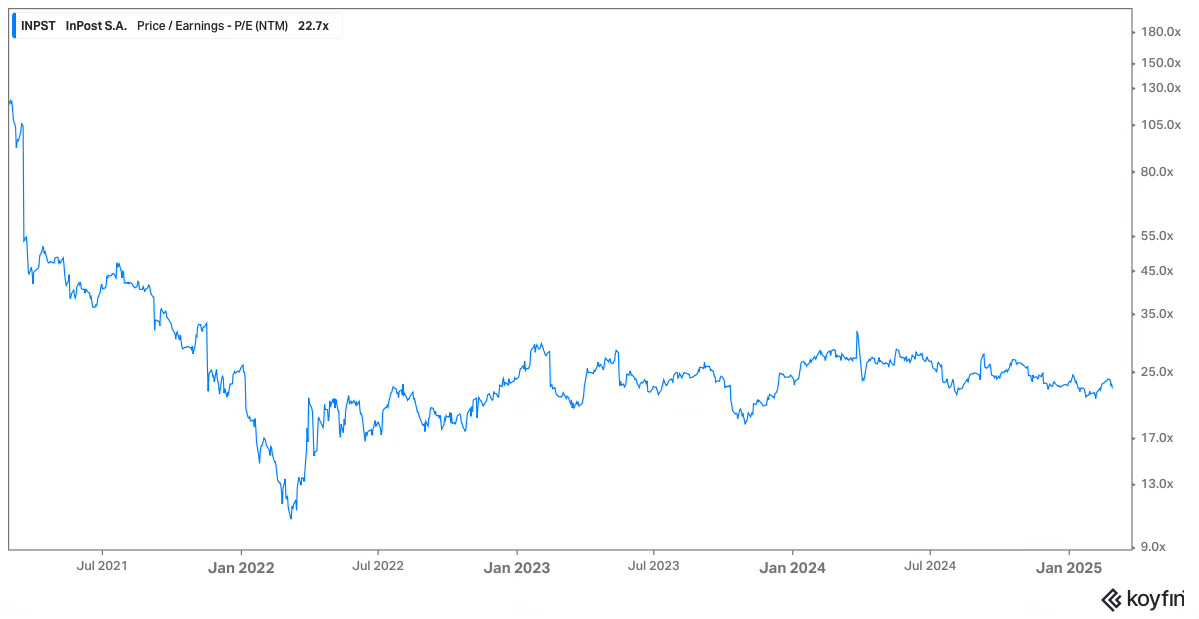

InPost (INPST)

InPost has been very busy executing on its international growth strategy over the past couple of months. This month saw very positive developments in the UK. This week, InPost launched label-free delivery in the UK. Until now, InPost was only available to customers who bought items from online retailers. Now, customer-to-customer deliveries are available, starting at £1.99, undercutting Royal Mail’s lowest price of £3.25. RIP Royal Mail.

Earlier in the month, InPost expanded its locker network at Aldi stores in the UK. First trialled in December 2023 and rolled out to 22 stores across the UK in March 2024, the lockers have received positive feedback from customers and have now expanded to 260 stores.

Lastly, the InPost app reached 14 million users in Poland this month, with 7.5 million using InPost Pay despite it only being launched one year ago. 22 times forward earnings for a business with such a long growth runway ahead of it feels too cheap to ignore.

ASML (ASML)

ASML is a new position, and one that I would like to build into a much larger weight. I am very comfortable adding below €700.

Some of the articles you might have missed during the past month:

Portfolio Review – January 2025

Uber: Record User Engagement

Adyen: Profit Margin Reaches Three-Year High

MercadoLibre: Accelerating at Scale

NU: Hidden Pressures Under the Hood

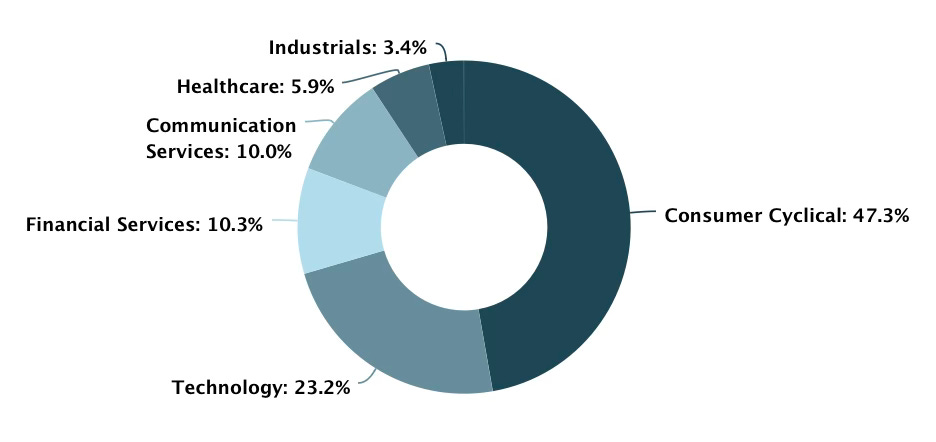

February was an extremely busy month for me, with a lot of earnings to cover. I’ve shared a number of reviews already, and you can expect more to come in March, starting with Sea Limited next week. The standout performers this month were Adyen and Mercado Libre, which is quite apt given they are my two largest positions. Despite a very strong start to the year for the portfolio, I am still seeing plenty of opportunities to deploy new capital. As the broader market index has remained relatively flat, these opportunities could become even better.

If you’d like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today’s edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com