In September 2019, Cargo Facts Consulting will publish a new report, the Global E-Commerce Logistics Outlook, to help companies craft their strategies towards a segment that has become increasingly important in logistics. This is the second of a series of articles leading up to the publication of the report that gives insight into our evolving research. At the link, find the first article focused on the logistics strategies of major e-commerce platforms.

This is not an easy time to be in the postal business.

The postal business has undergone fundamental shifts over the past decade. While postal companies worldwide have benefited from the growth of both domestic and cross border e-commerce, wholesale changes to the business model and scope of services will be necessary to survive and thrive.

Postal companies are key fulfillment agents in the e-commerce supply chain and most parcels moving through postal networks are e-commerce, although there are differences between markets. Figure 1 shows the share of packages associated with e-commerce in postal networks.

Figure 1 – E-Commerce Share of Packages in Postal Network

This has been good for revenue and volume growth. Over the last 10 years, the share of postal revenues from logistics and parcels have increased from 15% to 25%. During the same time, traditional mail volumes have continuously declined and represent only 39% of postal revenues today compared to 46% in 2017, according to statistics collected by the Universal Postal Union (UPU). Cargo Facts Consulting research has found that this shift in business mix has not necessarily been detrimental to profitability. Some companies, such as La Poste (France), Australia Post and UK Royal Mail have done extremely well. Others, such as the United States Postal Service, have seen losses increase.

Dependence on a single type of traffic is dangerous, given that the big e-commerce platforms have been insourcing their logistics operations and building their own inhouse delivery capabilities including last-mile delivery. The volumes most likely to move out of postal into private networks are those in higher-density urban areas. Postal companies that do not take a thorough look at their business model and evolve into different revenue streams may be left with the obligation to service a whole country but not enough volume in the cities to cross-subsidize this.

Some postal companies have been adapting to this change in the business environment and many smaller postal authorities operate beyond their traditional geographical boundaries and punch well above their weight. This includes the Luxembourg Post, Swiss Post, and Singapore Post, to name a few. These companies have moved beyond traditional delivery to offer a much wider suite of services including warehousing, pick and pack, or even launching their own e-commerce platforms to serve small and mid-sized businesses wary of the big e-commerce providers. Without any exception, those postal companies that have been successful have invested both in technology and infrastructure.

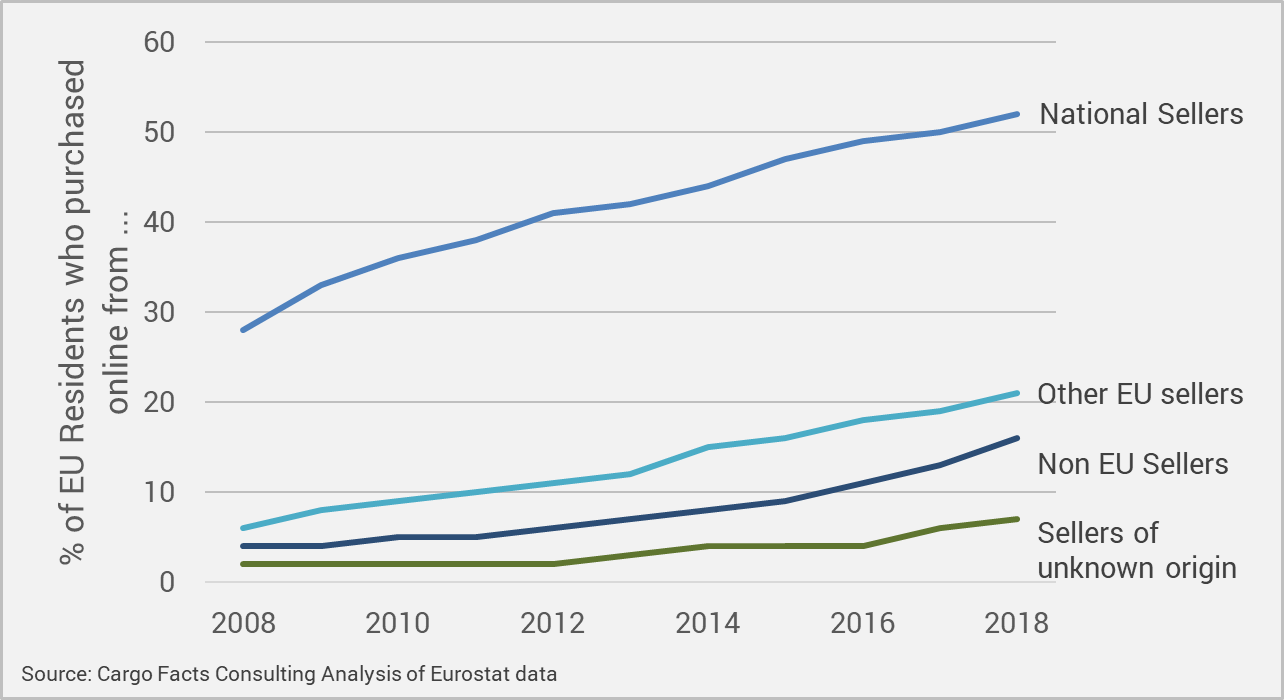

The most recent 2018 IPC Cross Border E-commerce Shopper Survey found that 71% of cross border e-commerce was delivered by postal companies. Cross border e-commerce growth, although smaller in volume than domestic e-commerce, has outpaced domestic growth. Figure 2 shows an example of this trend in the European Union, where usage of cross border channels has grown twice as fast as national ones.

Figure 2 – Development of Domestic vs Cross Border E-Commerce in the EU

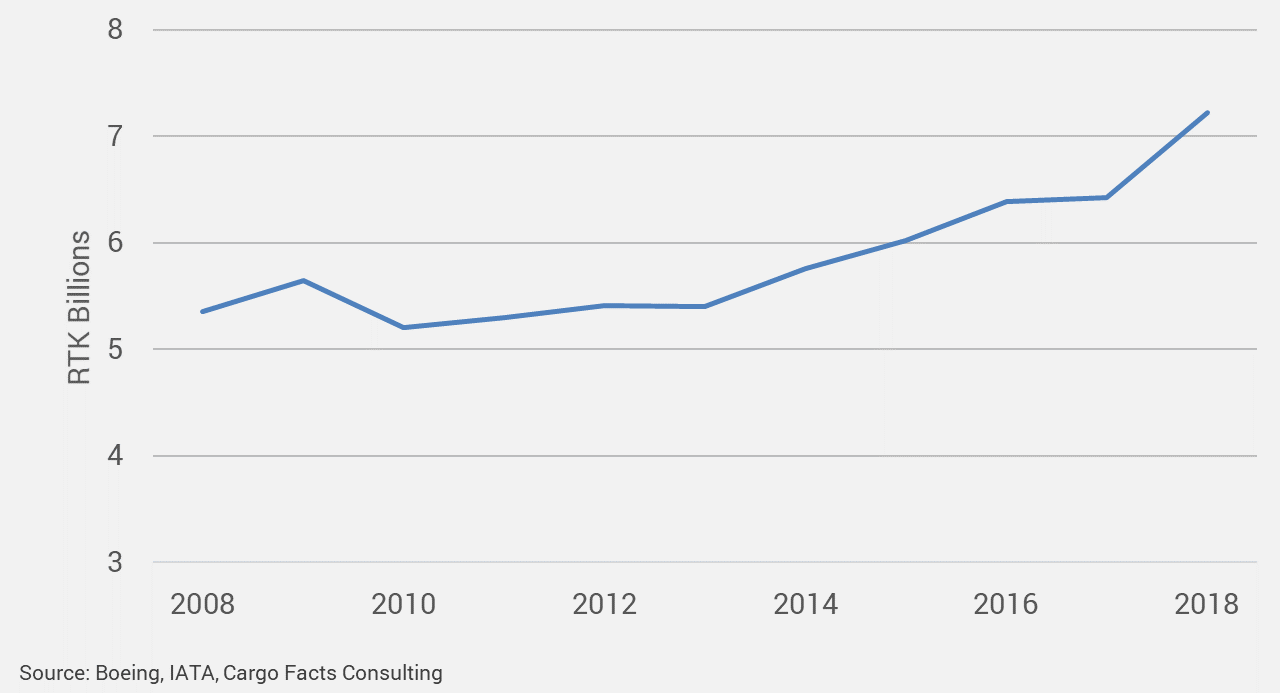

The growth in cross-border as well as domestic parcel traffic has also driven renewed growth of global postal traffic carried by air. Figure 3 shows the global air mail traffic measured in billions of revenue tonne kilometers (RTK) over the last 10 years. In 2018 world airmail traffic grew by 12%, significantly faster than general air cargo traffic, which only increased by 4%.

Figure 3 – Global Airmail Traffic 2008 – 2018

Postal companies are well-positioned to participate in the fulfillment of cross border e-commerce which due to customs clearance and return requirements is more complex than domestic e-commerce distribution. Those companies that have moved beyond last-mile delivery and ventured further upstream into value-added services, regional and even global distribution on behalf of cross border e-commerce platforms and logistics platforms have seen strong volume and revenue growth.

The Cargo Facts Consulting Global E-Commerce Logistics Outlook will cover the development of both domestic and cross-border e-commerce and its effect on multiple segments, including air cargo and contract flying, express, postal, and ground networks including last-mile delivery services. It will also take a detailed look at evolving fulfillment and logistics strategies of key global and regional e-commerce platforms, as well as at the relationships that are developing between different parties in the e-commerce value chain. The report discusses how companies are positioning themselves to benefit from year after year of double-digit e-commerce growth. Not all existing and emerging e-commerce logistics business opportunities are profitable or without risk. The report will provide insight into which prospects have the greatest potential. See www.cargofactsconsulting.com for details.

Frederic Horst is Managing Director of Cargo Facts Consulting. He can be contacted by clicking here.

1 – Reader Likes This Post

Source link