The Royal Mail share price had a relatively strong month in November. Indeed, the RMG stock price rose by more than 25% from its lowest level in November. This made it the second-best performing shares in the FTSE 100 index.

There are several reasons why the stock jumped in November. First, investors rushed to buy the dips considering that the stock was trading at a discount. Besides, the shares were lower by about 35% from the highest level this year. Still, it was about 22% above the lowest level this year.

Second, the stock rose because of the company’s decision to reward its shareholders with a major special dividend. The company announced that it will return about 400 million pounds through a combination of dividends and buyback.

The firm managed to grow its revenue and even reduce costs by about 56 million pounds. Still, its letters are still significantly below where they were before the pandemic started. Analysts at JP Morgan and Barclays also upgraded the stock.

Royal Mail share price forecast

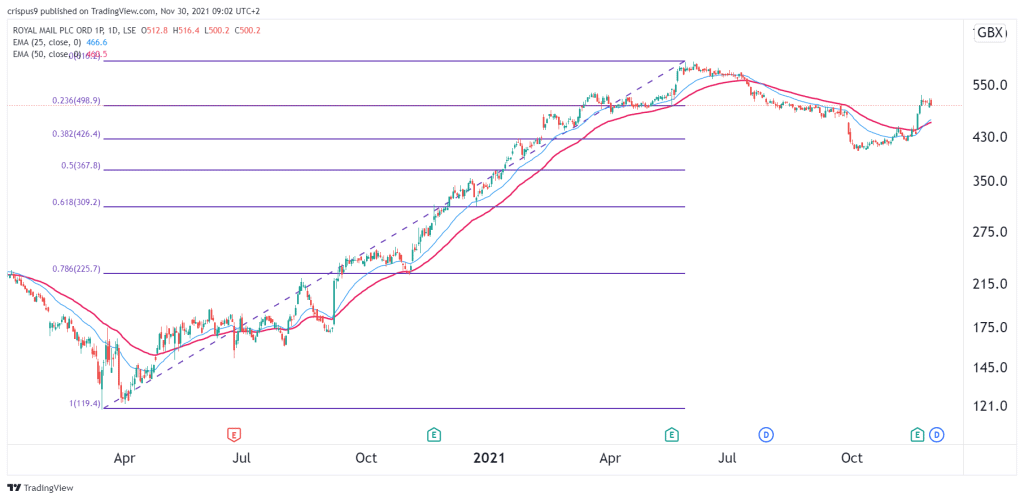

The daily chart shows that the RMG stock price made a strong recovery in November. Along the way, the stock managed to retest the 23.6% Fibonacci retracement level. At the same time, the 25-day and 50-day moving averages (MA) made a bullish crossover.

A closer look shows that the Royal Mail stock also formed a small inverted head and shoulders pattern. It has also formed a bullish flag pattern.

See also

Therefore, there is a likelihood that the stock will have a bullish breakout in December as investors target the key level at 550p. On the flip side, a drop below 450p will invalidate the bullish view.

Source link