Editor’s note: Seeking Alpha is proud to welcome Das Kapital Asia as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Essential. Click here to find out more »

Valuation is quite attractive – and supported by a strong yield

Following a sell-off and a reset in earnings expectations, Royal Mail Group (OTCPK:ROYMF) shares look quite undervalued, trading at about 8.3X consensus FY2020 (ending in Mar 2020) earnings, and just 3X on EV/EBITDA – while giving you close to an 8% dividend yield! Street expectations are changing, with several recent upgrades (albeit some from Sell to Neutral). It is worth building long positions, ahead of what we believe are bound to be the next round of upgrades.

Since its IPO in 2013 at a price of GBP 3.30, the Royal Mail Group (henceforth, Royal Mail or RMG) stock price has struggled. After dropping about 60% over the past year, its shares are struggling at just about GBP 2.00. Stateside, its shares (trading as ROYMF) have also fallen from over US$ 6 in May 2018, to about US$ 2.55 now. It has massively underperformed its peers like Deutsche Post (DPW, which trades as DPSGY in the US).

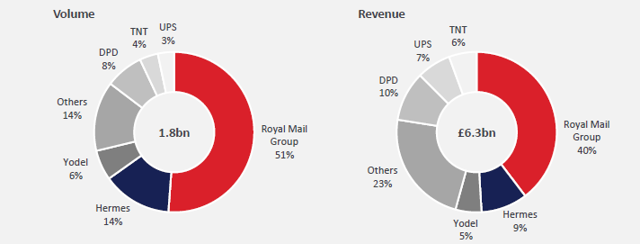

Royal Mail is no Deutsche Post DHL when it comes to parcel delivery and logistics. DPW, with its German efficiency, remains a global leader in that business – having close to a 50% share of even the Asian air cargo business. But RMG still has a decent business in its home market with a 40% share of parcels revenue (Hermes, the no. 2 player in the market, has only has a 9% share of the market). Its GLS division also has a decent footprint across Europe, and is now expanding in North America.

Dividends: Perfect for a yield-starved world

One of the many reasons for the drop in its stock price (the stock price is down 60% in the past one year) was an expectation that the company will be forced to cut its high dividend. That has already happened (announced with the annual results in late May 2019). RMG announced that its dividend will be set at a base of 15p a year, down from 25p.

But for the fiscal 2019 (that ended in Mar 2019), it will still be paying a final dividend of 17p, to be paid to shareholders in September 2019 (the stock goes ex-dividend on July 26, 2019). This means that investors buying now are looking at a current yield of 8.5%.

Even on the rebased 15p dividend going forward, the expected dividend yield is 7.5%. Looking at benchmark rates, UK gilts have a yield in the range of 0.6% and the Official Bank Rate is 0.75%. So investors are making a very nice spread here. Though RMG’s business is cyclical, and earnings can always come down, the focus on structural growth businesses – such as deliveries for e-commerce companies – as well as the management’s recent commitment to that dividend amount (rather than a payout ratio) means that the risk of dividends being lower than 15p a share are pretty low for now. RMG’s forecast free cash flow (FCF) yield of 10% also provides some comfort that the company will not be forced to cut dividends.

With a reset in dividend expectations, the market should not have any fears of further cuts. This, in our opinion, should provide a strong protection from any downside.

Moving from letters to parcels

Like other European postal companies, Royal Mail has its roots in delivering letters to its domestic customers. And like them, it has been moving away from this core to delivering parcels, as well as to ship them overseas. For now, mail, domestic parcels and European parcels account for roughly a third each of its revenues (Exhibit 1).

Exhibit 1: Domestic mail is only 37% of RMG’s revenues…

Source: Company data

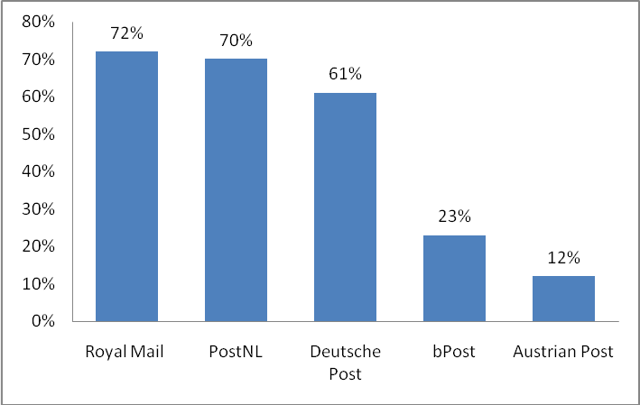

Despite its higher share of revenues though, mail currently contributes only 28% of its EBIT, with more than 70% of EBIT coming from its parcels business (Exhibit 2) – this is rising, and is higher than that of other European peers.

Exhibits 2: …while it makes over 70% of its EBIT from parcels – more than other peers

Source: Data from companies

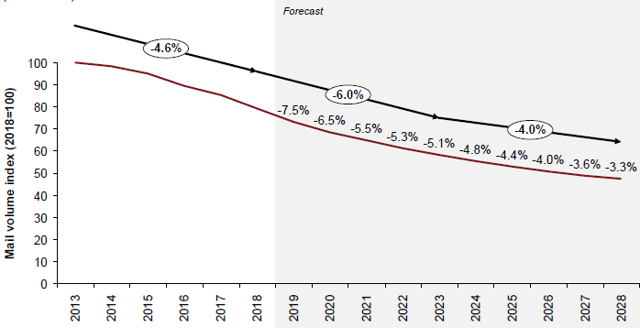

Unfortunately, according to Strategy&, UK domestic letter volumes are expected to decline 5% p.a. over the next decade (Exhibit 3), mainly driven by the drop in commercial or advertising mail, which together account for as much as 94% or letter volumes in the UK. There have been some price increases to offset the volume decline, but not enough to halt a drop in revenues.

Exhibit 3: Total volume of domestic letters, indexed (2018 = 100)

Source: Strategy&, May 2019

Luckily, there is growth in the parcels business, thanks to Amazon and other e-commerce companies in both the UK and other EU countries. While these companies have built up significant infrastructure in Europe (Amazon reportedly employs almost 80,000 people in Europe, and has 20 fulfillment centers in the UK alone), the e-commerce companies – for now – are still using companies like Royal Mail for their last-mile deliveries. In fact, compared to the US where Amazon has fewer service providers, it is working with many more providers in Europe for last-mile and line-haul services, with Royal Mail the main provider in the UK.

RMG may be dependent on Amazon for as much as 20% of its growing parcels business – higher than most other comparatively -sized postal companies (RMG, for its part, does not disclose these figures). While this growth is great at the moment, a future risk would be the inability to diversify away from one important customer. It is quite likely that Amazon will increasingly insource more of its deliveries in the future, leaving less business for service providers like RMG.

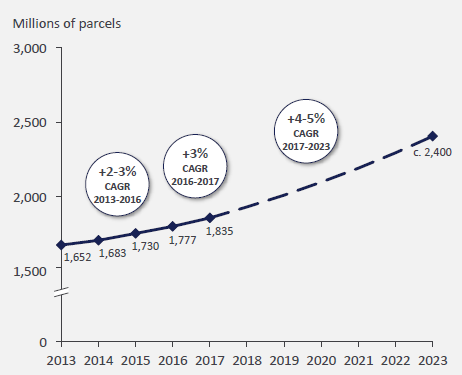

RMG is the number one player in the UK domestic parcels market with about half of the addressable market by volume and 40% by revenue (Exhibit 4) – a market that is expected to grow at 4-5% p.a. (Exhibit 5), in stark contrast to its mail market (Exhibit 3) which is expected to decline.

Exhibit 4: Royal Mail Group – Addressable UK domestic parcel market, 2017

Source: Royal Mail Group

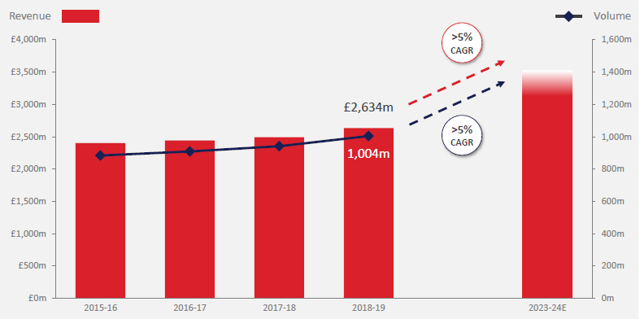

Exhibit 5: Royal Mail Group – Addressable UK domestic parcel volume…

Source: Royal Mail Group

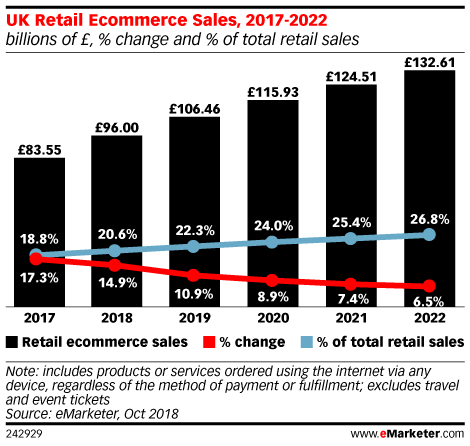

Exhibit 6: …based on the 8% CAGR expected in UK retail e-commerce sales

Source: eMarketer.com

RMG, for its part, is forecasting that its own parcels business will grow faster than its addressable market (Exhibit 7) – that is, it is hoping to grow its market share even higher than the current 40%. While this is questionable, RMG’s dominant position in the domestic market makes it RMG’s market to lose.

Exhibit 7: Royal Mail Group domestic parcels – Volume and Revenues

Source: Royal Mail Group

One of the ways that RMG is hoping to achieve this is by more closely integrating itself with key customers like Amazon and Ebay. RMG is setting up locker banks across the countries where customers can come and pick up their parcels at their own convenience. It is also setting up parcel posting boxes to help small-scale sellers on e-commerce sites post parcels, or for customer to returns them. By setting up its first three parcel hubs by 2023, essentially, RMG plans to redesign its entire network around parcels.

None of these initiatives is particularly revolutionary. Companies like Deutsche Post DHL and even DPD within the UK appear to have a leg up in these types of offerings. There is an issue of mail legacy with Royal Mail, which it needs to overcome, to compete more effectively with stand-alone delivery specialists. But with the new(ish) CEO Rico Back who comes from its GLS parcels business, perhaps RMG can leverage its leading footprint and network to remain ahead of the competition.

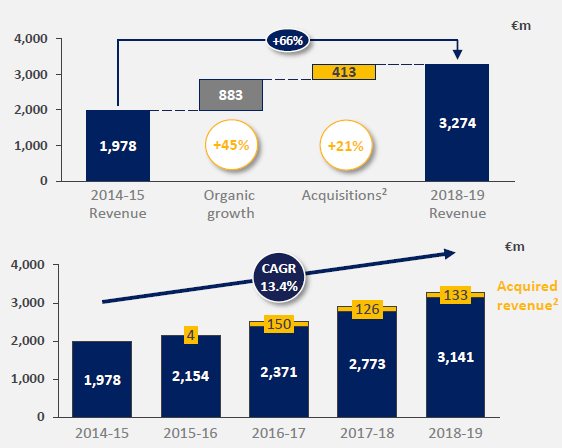

The GLS business itself provides a model of where RMG’s future growth will come from. This (primarily European, but increasingly expanding in North America) parcel delivery business has been a success (and accounts for the ascension of its CEO Back to the role of overall CEO of RMG). The GLS division has been fuelled by several acquisitions over the past two decades. This has helped it grow its revenues at a CAGR of over 13% over the past four years (Exhibit 8). The GLS division accounted for about 52% of RMG’s operating profit despite only accounting for 31% of revenues in FY2019. But it is expected to grow to close to 36-37% of RMG’s FY2024 revenues. So its outsized margins mean that the GLS division could drive its profits faster in the future.

Exhibit 8: GLS division – Revenue growth: organic and acquisitions

Source: Royal Mail Group

Risk factors

- Companies like Royal Mail have high fixed costs (including, but not limited to, staff costs); thus falling volumes in this business needs to be offset elsewhere. A sharper-than-expected drop in domestic mail services and/or RMG’s inability to successfully raise prices to offset this drop. Luckily, RMG’s regulator has a light touch, and it may be able to raise prices more easily compared to its European peers.

- Longer term, Amazon and other e-commerce companies are planning to do more deliveries themselves.

- Brexit poses some risks, especially to its European parcels business, if it ends up causing some trade problems. This is a more serious risk in the case of a “no-deal” Brexit.

- A potential change in government that brings Jeremy Corbyn to power. Corbyn has mentioned that he would like to re-nationalize companies like Royal Mail.

Recent results and outlook

On May 22, RMG announced its results for the fiscal year ended Mar 31, 2019. It grew revenues 3% yoy to GBP 10.4bn. It achieved EBIT (pre-transformation costs) of GBP 509m, in line with what consensus was expecting. However, its reported EBITDA and net income both dropped.

Based on company’s guidance, there is some doubt if the current fiscal year ending in Mar 2020 will see the bottom line grow. The consensus, however, is expecting some growth – though those do not yet appear to have been tempered by the recent results. Either way, consensus does expect even stronger growth in earnings of about 15% the following fiscal year, FY 2021. We also take some comfort from the dividend guidance that the management appears to have committed to.

Either way, after years of decline, RMG may be poised for a turnaround in its fortunes. It has muted returns on capital and its ROE is only about 6%; its recent returns on capital are not above its cost of capital. Arguably, the recent historical metrics of RMG are not very complimentary, and after years of patience, investors appear to have given up on the stock. All this is reflected in its stock price – which is trading at 8.3x earnings, compared to a peer like Deutsche Post, which is trading at 12.5x.

For me, therein lies the opportunity. I would rather buy a stock that suffers from the market’s low expectations, rather than one that is primed for perfection (and thus, could disappoint). In the meantime, I am being paid to wait – by collecting the 7.5% dividend yield.

Arguably, this may not be enough for everyone; some may even think of it as a “value trap.” But for me, this is like a convertible bond with a large coupon. You have a call option on the underlying equity which may perform and give you a huge upside; otherwise, you will at least have collected a very nice coupon. There are not too many opportunities like that out there.

Disclosure: I am/we are long ROYMF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I/we have a long position in its UK-listed shares, RMG.L.