There are a number of important rule changes set to come into force next month.

Laws on things such as minimum and living wage will be altered from the end of this week with changes to Scotland’s Covid rules also set to come into force before the end of April.

Scots will also soon see a number of changes made to tax – including the introduction of plastic packaging tax that is set to impact manufacturers and customers alike.

Other rules – such as limits on red diesel – will also be introduced from April in a bid to reduce the use of the rebated duel.

In order to help you understand the upcoming changes, we have listed them below…

National minimum wage changes

Thousands of workers across Scotland are set to receive a wage rise as changes to the ‘National Living Wage’ and ‘National Minimum Wage’ come into force from April 1.

The current minimum rates for Scots workers are:

- Apprentice – £4.30

- Under 18 – £4.62

- 18 to 20 – £6.56

- 21 to 22 – £8.36

- 23 and over – £8.91

The UK Government has said that the National Living Wage will increase by 59p, which is a rise of 6.6 per cent.

Chancellor Rishi Sunak said that the rise will “benefit over 2m of the lowest paid workers in the country”.

The increase will see rates rise to:

- Apprentice – £4.81

- Under 18 – £4.81

- 18 to 20 – £6.83

- 21 to 22 – £9.18

- 23 and over – £9.50

Changes to red diesel rules

Major changes to diesel laws are coming into force from April 1.

The new laws mean that certain types of the fuel will only be allowed for specific purposes.

This includes rebated diesel – sometimes referred to as red diesel – as well as rebated biofuels.

From next April 1, the use of rebated fuels is only permitted for set purposes including when using washing machines, vehicles, vessels and appliances.

Despite the use of the fuel being allowed for these purposes, there will be additional fees applied.

The rebated fuels affected by these changes are:

- rebated diesel

- rebated Hydrotreated Vegetable Oil (HVO)

- rebated biodiesel

- bioblend

- kerosene taxed at the rebated diesel rate

- fuel substitutes

From April, it will no longer be legal to use red diesel for non-road mobile machinery such as bulldozers and cranes or to power mobile generators on construction sites.

According to the government, red diesel currently accounts for 15 percent of total diesel for the UK.

Introduction of plastic packaging tax

(Image: Getty)

In a bid to crackdown on the use of single-use plastic waste, the UK Government will introduced a plastic packaging tax from April 1.

The new measures will impact UK manufacturers of plastic packaging, importers of plastic packaging, business customers of manufacturers and importers of plastic packaging.

In addition to this, millions of members of the public will be impacted if buying plastic packaging or goods in plastic packaging.

According to the government, the tax will apply “to plastic packaging manufactured in, or imported into the UK, that does not contain at least 30 percent recycled plastic.”

However, imported plastic packaging will be liable to the tax, whether the packaging recycled or not.

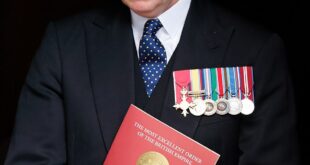

Increase price of Royal Mail stamps

(Image: PA)

From April 4 this year, the cost of Royal Mail stamps is set to increase.

First class stamps will increased by 10p to 95p, while the price of second class stamps will go up by 2p to 68p.

The changes come amid a decline in the number of letters being posted by the firm.

Since 2004/05, the number of letters being posted has fallen by more than 60 per cent with a 20 per cent dip in letter volumes since the start of the Covid pandemic.

VED car tax rises

VED – better know as car tax or road tax – is set to increase in line with the measure of inflation from this April.

The car tax increase will impact most car but the rate will increase the most for vehicles within the highest emission ranges.

The amount of car tax each driver pays depends on the age and environmental friendliness of your car.

We’ve broken down more of the rates below:

- For cars that emit between 51 and 75g of CO2 per km, the standard rate will increase from £155 to £165, while your first year rate will stay at £25.

- If your car emits between 76 and 90g per km, your standard rate will rise from £155 to £165, while your first year rate will increase from £115 to £120.

- If your car emits between 91 and 100g of CO2 per km, your standard rate will increase from £155 to £165 and your first year rate will rise from £140 to £150.

- For cars producing CO2 of between 101 and 110g per km, the standard rate will increase from £155 to £165 and the first year rate will increase from £160 to £170.

- If your car’s emissions are between 111 and 130g per km, your standard rate will increase from £155 to £165, while your first year rate will rise from £180 to £190.

- If your car emits between 131 and 150g of CO2, your standard rate will increase from £155 to £165 and your first year rate will rise from £220 to £230.

The following types of car owners pay no car tax:

- Owners of brand new cars that produce 0 grams of carbon dioxide (CO2) emissions and have a price of less than £40,000

- Owners of a car registered between 1 March 2001 and before 1 April 2017 that produces up to 100 grams of CO2 per kilometre driven.

Changes to Covid rules in Scotland

Scotland currently continues to operate under ‘baseline’ Covid measures – meaning that face masks are still required in indoor public places as well as testing and self isolation rules remaining in place.

However, First Minister, Nicola Sturgeon, is set to give an update on the coronavirus situation in Scotland tomorrow.

Nicola Sturgeon has been urged to ditch face mask rules in Scotland despite previously delaying the move.

The First Minister will make a statement at Holyrood on Wednesday amid speculation the few remaining restrictions will not be ended.

- An end to lateral flow testing for the general public

The rules on lateral flow testing are set to change in Scotland from April 18.

However, the rules surrounding Covid are often subject to change with delays possible.

Currently, from April 18:

- free LFTs will no longer be available to the general population

- free LFTs will continue to be available to those people still asked to test, such as health/care workers, patients, or those visiting vulnerable individuals in care homes or hospitals

- Routine Covid testing to end

As explained above, rules and dates are subject to change when it comes to Covid-19 related measure throughout Scotland.

However, as it stands, there are some huge changes set to come into force after April.

Until April 30:

- people with Covid symptoms should self-isolate and get a PCR test

- vaccinated close contacts of positive cases should do daily LFTs for seven days

From May 1:

- people with Covid symptoms will no longer be required to take a need to test – whether it be a PCR or lateral flow

- physical test sites are set to close

- contract tracing set to end

Don’t miss the latest news from around Scotland and beyond – Sign up to our daily newsletter here .