Sign up here for our daily coronavirus newsletter on what you need to know, and subscribe to our Covid-19 podcast for the latest news and analysis. Italian Prime Minister Mario Draghi’s administration is about to accelerate Italy’s Covid-19 vaccination program, taking inspiration from the U.K. campaign, in an effort to …

Read More »U.K. Prioritized Virus Fight Over Transparency, Hancock Says

Sign up here for our daily coronavirus newsletter on what you need to know, and subscribe to our Covid-19 podcast for the latest news and analysis. The U.K. government failed to meet some deadlines over publishing coronavirus-related contracts because it was acting “incredibly quickly” to secure equipment at the height …

Read More »Walmart Misses Q4 Profit Forecast, Tops $150 Billion Sales

Walmart Inc. (WMT) – Get Report posted weaker-than-expected fourth-quarter earnings Thursday, thanks in part to a charge linked to taxes in the United Kingdom, but still managed record sales of more than $150 billion as U.S. shoppers continued to favor big-box retailers over smaller rivals. A planned surge in investment costs, …

Read More »Walmart, Hormel Foods, Marriott, others

Check out the companies making headlines before the bell: Walmart (WMT) – Walmart reported adjusted quarterly earnings of $1.39 per share, which includes a 7-cent impact from UK tax repayment. The consensus estimate had been $1.50. Revenue did beat forecasts, and US comparable sales excluding fuel were up 8.6% compared …

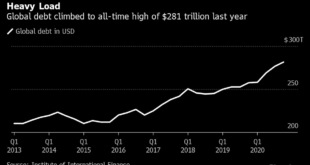

Read More »World Debt Reaches Record $281 Trillion

The world has never been more indebted after a year of battling Covid-19. And there’s even more borrowing ahead. Governments, companies and households raised $24 trillion last year to offset the pandemic’s economic toll, bringing the global debt total to an all-time high of $281 trillion by the end of …

Read More »U.K. Inflation Ticks Higher on Its Way Toward BOE’s 2% Target

Photographer: Hollie Adams/Bloomberg Photographer: Hollie Adams/Bloomberg U.K. inflation unexpectedly accelerated in January, in what economists say is the first step toward a significant increase that could bring the rate close to the Bank of England 2% target later this year. Prices climbed 0.7% from a year earlier, boosted by the …

Read More »Two Million? Five Million? Real Size of U.S. Blackouts a Mystery

A sign on the door of a local business in McKinney, Texas, on Feb. 16. Photographer: Cooper Neill/Bloomberg Photographer: Cooper Neill/Bloomberg It’s not easy putting a number on what is undoubtedly the largest forced blackout in U.S. history. If you take the Texas power grid operator’s word for it, the …

Read More »Banking regulator says pandemic uncertainty means now is not the time to consider higher dividends, share buybacks

Bank buildings at Toronto’s financial district on Sept. 3, 2020. Fred Lum/The Globe and Mail Canada’s banking regulator will not yet consider lifting restrictions on banks’ dividends and share buybacks introduced at the start of the pandemic, even though the largest lenders continue to amass growing stockpiles of surplus capital. …

Read More »Pound loses ground as Brexit talks go to the wire – live updates

Good morning. Retail data dominates the agenda today, with sales figures for November due out at 7am. They’re expected to show a contraction in spending last month, with a large number of retailers closed due to heightened restrictions in much of the UK. It’s scheduled to be quiet on corporate …

Read More »FTSE 100 pauses for breath after surging on new vaccine news as easyJet reports huge Covid-19 losses

T he FTSE 100 was set to pause today after Monday’s surge which saw UK stocks leap 1.7% as travel, transport and leisure shares rallied. A flurry of global takeover deals added to the excitement that went through global markets after US biotech firm Moderna announced its coronavirus vaccine trial …

Read More »