The Royal Mail share price has made a spectacular comeback as investors focused on the rising Covid-19 cases and the possibility for new lockdowns. The RMG stock is trading at 503p, which is the highest it has been since July 19th. It is still about 65 points below the highest level this year.

Royal Mail is the biggest letter and parcel company in the UK. Therefore, there is a likelihood that the company will benefit substantially if the number of Omicron cases in the UK keeps rising. Indeed, the only reason why the company was put into the FTSE 100 is because of its strong performance during the lockdowns.

Now, there is chatter that the Boris Johnson administration will announce a new lockdown after Christmas. The new lockdown will encourage more people to work from home. It could lead to the closure of the so-called non-essential businesses like bars, cinemas, and pubs. As such, if this happens, there will be a high demand for Royal Mail’s services.

The RMG share price has also recovered as investors cheer the recent actions by the company. The firm acquired Rosenau in a bid to expand its Canadian presence. The company also recently announced a 400 million pound windfall to investors.

Royal Mail share price forecast

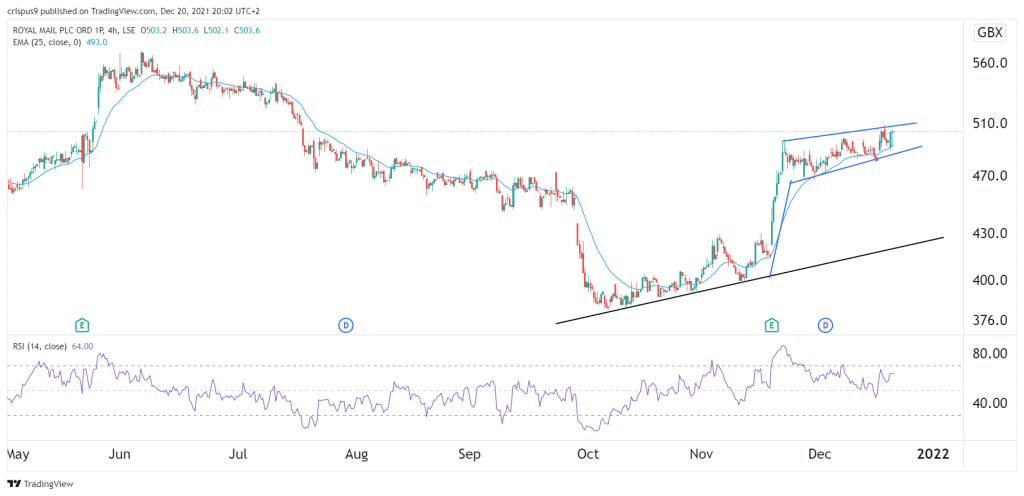

The four-hour chart shows that the Royal Mail stock price surged to a year-to-date high of 569p a few months ago. It then declined by about 33% and reached a low of 382p in October this year. It is now trading above the important resistance level at 500p. It has also formed a bullish flag pattern and moved above the 25-day and 50-day moving averages.

Therefore, the outlook for the Royal Mail share price at the current level is relatively bullish. The next key level to watch will be at 520p. This view will be invalidated if the stock falls below 480p.

See also

Source link