Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

UK government borrowing fell in December thanks to a rise in tax receipts, despite a jump in the cost of repaying the national debt.

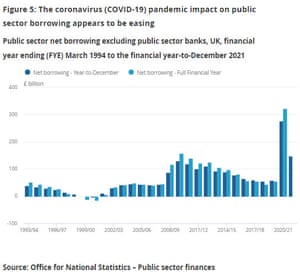

Public sector net borrowing, excluding state banks, dropped to £16.8bn last month, less than expected. That’s £7.6bn less than in December 2020, as the economy recovers from the impact of the pandemic.

It’s the fourth-highest December borrowing since monthly records began in 1993 (the UK borrowed more in both December 2009 and 2010 during the economic downturn following the global financial crisis).

Tax receipts rose by £6.2bn year-on-year, including a rise in corporation tax, stamp duty, income tax, VAT and fuel duty receipts.

Government spending fell by £1bn, as the furlough job protection scheme and support for self-employed workers wrapped up last autumn.

Office for National Statistics (ONS)

(@ONS)Public sector net borrowing excluding public sector banks was £16.8 billion in December 2021.

This was the fourth-highest December borrowing since monthly records began in 1993, £7.6 billion less than in December 2020 https://t.co/VeWpJowhEa pic.twitter.com/PtRhsRoP97

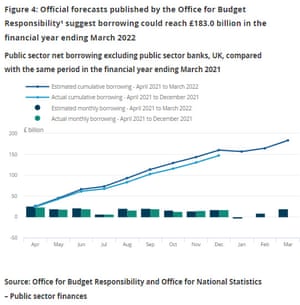

Borrowing so far this financial year is still running below forecasts. The UK has now borrowed £146.8bn since April, £129.3bn less than a year ago and £12.9bn less than the official Office for Budget Responsibility forecast.

That could intensify calls for the government to make a dramatic U-turn on its planned national insurance tax increase, as the cost of living crisis worsens.

Yesterday, former Conservative cabinet minister David Davis threw his weight behind calls for the tax increase due to come in from April to be scrapped.

However, the interest payments on UK government debt tripled year-on-year in December, due to rising inflation.

Interest payments on central government debt hit £8.1bn in December 2021, a December record and £5.4bn more than in December 2020. That’s due to the jump in the RPI inflation rate, which pushed up the cost of repaying index-linked gilts (government bonds, whose interest rate is fixed to RPI).

Scott Beasley

(@SkyScottBeasley)🤕 💷 Ouch. There’s a real warning in todays public borrowing figures about the impact of soaring inflation on government debt payments – which jumped to £8.1bn in December alone – much more than forecast as RPI hit 7.5%

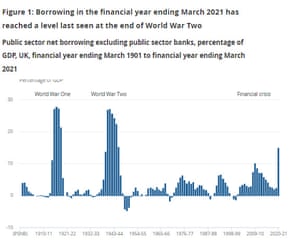

Overall, the UK’s national debt was £2,339.9bn at the end of December 2021 or around 96.0% of gross domestic product — the highest ratio since March 1963 when it was 98.3%.

Reaction to follow…..

Also coming up today

Global stock markets remain on edge, after a dramatic day’s trading on Monday.

Asia-Pacific markets have dropped, amid fears that Russia could invade Ukraine and worries that the US Federal Reserve would wind down its support for the economy faster than expected.

European markets slumped yesterday, but after joining the rout, Wall Street staged a rapid late recovery to finish slightly higher.

Michael Hewson of CMC Markets says:

Yesterday’s declines in European markets had more to do with events on the Ukraine, Russia border than with any other factors that have dominated sentiment over the past two weeks.

It appears that the penny has finally dropped with financial markets that events in eastern Europe have the potential to get even worse, after NATO announced it is putting additional ships and aircraft on standby for mobilisation, and that the US is considering sending troops to shore up its Baltic defences, in response to requests from the likes of Estonia for a greater US presence to deter a potential Russian escalation.

European shares are expected to open higher today, but the New York market is currently forecast to drop when it reopens. More volatility ahead.

Jeremy Naylor

(@JeremyNaylor_IG)#Tuesday mkts: #UkraineCrisis adds to market woes about higher rates. Deep losses sees buyers coming back in, BUT but potential further losses expected. #VIX near 1yr high. #JPY 5wk highs vs USD EUR & GBP. #Gold 6wk highs. #EarlyMorningCall 07:30amUK – https://t.co/B1fxa2jESa pic.twitter.com/qTMUi28Zm7

The agenda

- 7am GMT: UK public finances for December

- 9am GMT: IFO survey of German business climate

- 11am GMT: CBI’s industrial trends survey of UK manufacturing

- 3pm GMT: US consumer confidence report for December