New GDP figures today show the UK economy picked up pace before Omicron struck.

The growth of 0.9% in November was much better than the 0.4% expected and meant GDP exceeded its pre-pandemic level for the first time.

The figures from the Office for National Statistics came as more retailers disclosed how they fared during the Omicron-hit festive season. Currys trimmed profits guidance after describing the technology market as challenging, although it said it grew market share.

FTSE 100 Live Friday

-

Short seller targets Royal Mail

-

Currys lower profits guidance, shares fall

-

Facebook hit with UK class action

-

B&M shares fall as CEO cuts stake to 7%

Trustpilot CEO talks going public, fake reviews and more

12:02 , Oscar Williams-Grut

Trustpilot went public in a £1.1 billion IPO on the London Stock Exchange last March and figures published this week show revenue was up 29% to $131 million (£95.3 million) in the six months to 31 December, ahead of forecasts.

CEO and founder Peter Holten Mühlmann spoke to the Standard ahead of the latest numbers and our chat with him is in today’s paper.

“I think we are only 1% of what we can become,” Holten Mühlmann says at his swish new London base on the City’s Mincing Lane. “Today we have around 160 million reviews on the platform, but there should be billions.”

Read the full interview.

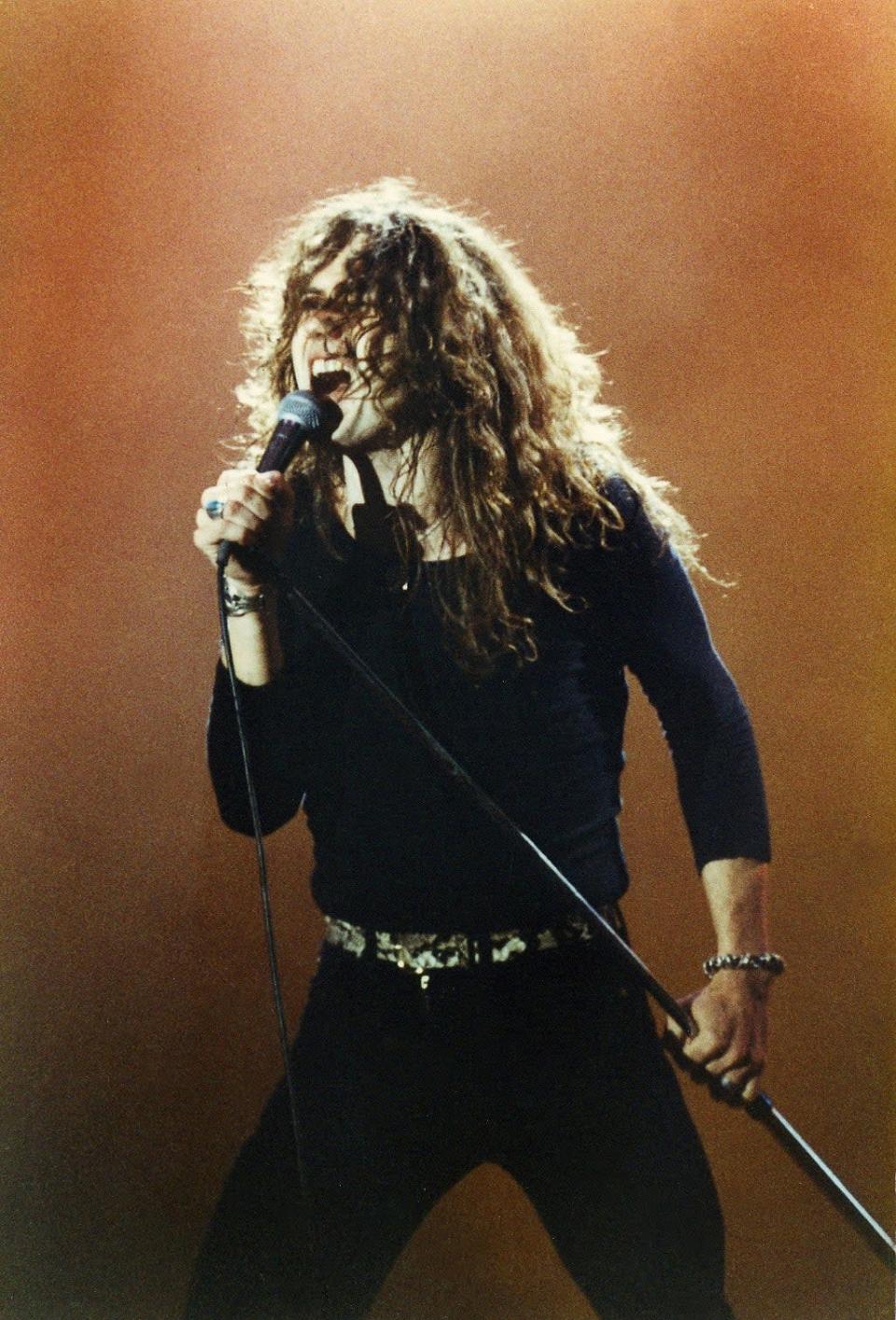

Coverdale cashes out

11:47 , Simon Freeman

Whitesnake and Deep Purple frontman David Coverdale is the latest weathered rocker to cash in on his back catalogue.

Coverdale, 70, has sold publishing and master rights from recordings across his 50-year career to London-listed Round Hill Music for an undisclosed sum.

The haul includes Deep Purple’s gold-selling Stormbringer and Whitesnake’s eponymous 1987 multi-platinum album, featuring power-ballad Here I Go Again.

Josh Gruss, CEO of Round Hill, said: “He has blazed a trail since the early Seventies, and his legacy and influence cannot be understated.”

Coverdale said he was “thrilled beyond words”.

David Bowie’s estate, Bob Dylan, Neil Young and Bruce Springsteen are among rock legends to have sold their back catalogues to the new breed of streaming rights companies of late.

$300m question mark over miner’s accounts

11:35 , Simon Freeman

KPMG has uncovered transactions of “potential concern” worth more than $300 million in a forensic audit of FTSE 250-listed gold miner Petropavlovsk’s accounts.

The report suggests that costs of mining licences may have been inflated, while expenses and investments were potentially diverted into accounts associated with the Russia-focused group’s senior managers in the three years to August 2020.

The study does not draw conclusions on specific wrongdoing but does “establish some clear patterns of inappropriate behaviour and points to possible lapses in corporate governance and controls”.

The company, founded by Peter Hambro and Pavel Maslovskiy in 1994 and chaired by US lawyer James W Cameron Jr, said it will review the findings and take appropriate action.

Cameron said: “We hope to draw a line under the corporate governance lapses that, in the past, may have permitted individuals within the company to personally benefit from corporate transactions.

“We have been working diligently over the course of this year to install new rules, policies and procedures and instilling a culture of zero tolerance for improper business practices.

“We look to the future with confidence that the business practices described in the report cannot and will not be repeated.”

Is this the top?

11:25 , Oscar Williams-Grut

Share sales by the bosses of B&M and JD Sports in the last two days will leave many investors wondering if this could be the top after what has been a bumper Christmas for retailers.

SSA Investments, the family office of B&M CEO Simon Arora, sold 40 million shares in B&M overnight at a price of 585p — a 1.8% discount to Thursday’s closing price.

Shares dropped 19.2p, or 3.2%, to 577.4p today, leaving it near the bottom of the FTSE 100.

JD Sports executive chair Peter Cowgill surprised the market on Thursday afternoon as he cut his holding in half. Cowgill raised just over £200 million selling 10 million shares. The move sent JD’s stock plummeting 7% yesterday, though it recovered 2.75p to reach 200.7p this morning.

Retailers including both JD and B&M have delivered a slew of profit upgrades over the last fortnight. The sector faces a much more uncertain 2022 as soaring energy costs squeeze household finances.

Read the full story.

Short-selling disclosure dents Royal Mail

10:38 , Graeme Evans

Bets against Royal Mail have backfired in spectacular fashion over recent years, but that’s not deterred one hedge fund from having another go.

Disclosures show that Marshall Wace has taken a short position of five million shares, equivalent to 0.5% as it eyes the company’s turnaround running out of steam.

Royal Mail has seen off the hedge funds once before, having benefited from the pandemic surge in parcel deliveries and the support of major shareholder Daniel Kretinsky.

A £200 million special dividend and buyback programme has just fired shares over 500p but the stock fell back 4% or 18.6p to 507.6p today amid jitters over the short position.

Royal Mail topped the FTSE 100 fallers board, but there was better news for the holders of two other popular stocks.

BT shares rose by a penny to 179.15p after UBS analyst Polo Tang removed his “sell” recommendation. Rising broadband infrastructure competition for Openreach remains a worry, however, as Tang pegged his new price target at 170p.

Lloyds Banking Group shares also benefited from broker comment today, lifting 0.3p to 54.3p after Investec’s Ian Gordon predicted further upside for the shares.

The lender is now at a 22-month high after a strong start to the year, but Gordon thinks they deserve to be at 60p. As well as the margins boost from higher interest rates, he sees the potential for £1 billion a year of share buybacks through to 2024.

The FTSE 100 index fell 6.80 points to 7557.06 as Thursday’s big reversal for Wall Street’s Nasdaq put pressure on Scottish Mortgage Investment Trust and other tech-focused plays.

Housebuilder Berkeley was one of the biggest risers after Deutsche Bank switched its recommendation to “buy” and moved its price target to 5429p, helping shares to rise by 65p to 4551p.

Deutsche Bank is more cautious on other housebuilders, however, with sector heavyweight Persimmon losing its “buy” rating.

The FTSE 250 index fell 50.66 points to 22,907.85, amid a further 4% reversal for Marks & Spencer shares after yesterday’s trading update ended a strong run for the retailer.

Cineworld shares were steady at 38.85p after the UK and US-focused operator reported a strong December, with “Spider-Man: No Way Home” the first film to gross more than $1.5 billion (£1.1 billion) since the pandemic started.

Fortnum & Mason slumps to first loss in 12 years

09:33 , Oscar Williams-Grut

Sales of pistachio & clotted cream biscuits and sparkling tea over Christmas have helped the Queen’s grocer Fortnum & Mason bounce back from its first annual loss in 12 years.

The upmarket food shop, which has a close association with the royals, flagged the biscuits and tea as standout sellers over the festive period. Demand saw sales rise 21% in the five weeks to 26 December compared to a year earlier.

The bumper performance came after a lockdown-induced slump. Accounts filed today show the business lost £2.7 million in the 12 months to July 2021 as turnover dropped 6% to £132 million. It marks the company’s first annual pre-tax loss since 2009.

Fortnums blamed the pandemic, which forced it to shut its iconic Piccadilly store.

Read the full story.

Facebook hit with UK class action

08:51 , Oscar Williams-Grut

Meta, the parent company of Facebook, faces a surprise class action lawsuit in the UK seeking at least £2.3 billion in damages.

Lawyers have written to Meta informing it of a class action claim in the UK based on the company’s historic data collection practices. They plan to file paperwork for the case shortly.

The case is being bought by Dr Liza Lovdahl Gormsen, a senior research fellow at the British Institute of International and Comparative Law (BIICL) and the director of the Competition Law Forum. It is being handled by law firm Quinn Emanuel Urquhart & Sullivan and funded by Innsworth Litigation Funding.

The case argues that Facebook “abused its market dominance” by forcing UK users to accept aggressive data collection practices if they wanted to sign up for the social network.

The “first of its kind” case is being bought on behalf of Facebook’s 44 million UK users and covers the period October 2015 to December 2019. It is being bought under the Competition Act.

Read the full story.

B&M shares falter, Berkeley rallies on upgrade

08:50 , Graeme Evans

B&M European Value Retail is under pressure in the FTSE 100 index after it emerged that chief executive Simon Arora and his family have raised £234 million by offloading 40 million shares, reducing their stake from 11% to 7%.

The FTSE 100 index fell 6.71 points to 7557.14 as yesterday’s Nasdaq sell-off put pressure on Scottish Mortgage Investment Trust and other tech-focused businesses.

Housebuilder Berkeley is one of the biggest risers in the top flight after Deutsche Bank switched its recommendation from “hold” to “buy”. It also changed its price target from 4555p to 5429p, lifting shares by 77p to 4563p.

Deutsche Bank is more cautious on other housebuilders, however, with sector heavyweight Persimmon losing its “buy” rating.

Currys shares are down 6% in the FTSE 250 index as the electricals retailer revealed that 2021/22 profits will be around £155 million, compared with previous guidance of £160 million.

Currys hit by supply chain issues

08:36 , Oscar Williams-Grut

Electronics retailer Currys has been hit by supply chain problems that led to trouble sourcing goods over Christmas.

Sales dropped by 5% in the 10 weeks to 8 January compared to the same period a year earlier. The company cut its profit guidance as a result, saying it now expects pre-tax earnings of £155 million for the full-year rather than the previously guided £160 million.

CEO Alex Baldock said: “The Technology market was challenging this Christmas, with uneven customer demand and supply disruption. Against this backdrop, Currys’ colleagues showed their resilience and the stronger business we’ve built.

“We gained market share, improved customer satisfaction, traded profitably, and can look ahead with confidence.”

Shares dropped 4.7p, or 4.2%, to 107.8p.

Read the full story.

Lloyds shares backed to go higher

08:21 , Graeme Evans

The tailwinds driving Lloyds Banking Group at the start of 2022 today led to more City support for the FTSE 100 stock.

A strong January so far means shares are already at a 22-month high of 54p, but Investec’s Ian Gordon sees further gains after upping his price target to 60p.

As well as the margins boost offered by higher interest rates, he sees the potential for £1 billion a year of share buybacks through to 2024 as balance sheets provisions are released.

Gordon said: “We remain positive on the UK banking sector and see further upside for Lloyds.”

Nasdaq falls puts pressure on London market

07:42 , Graeme Evans

A late slide for the tech-focused Nasdaq means European markets are forecast to open lower, undoing some of the progress during an otherwise decent week for investors.

The FTSE 100 index, which has been at its highest level since January 2020, is expected to dip 38 points to 7525.

The Nasdaq declined 2.5% last night and recorded its lowest daily close since October as investors rotated from high growth stock towards value and cyclical plays.

The performance on Wall Street is a continuation of the volatility seen so far in 2022 as investors weigh up the outlook for higher interest rates in the United States.

Futures trading is pointing to a flat start for US markets later, but much will depend on the content of economic releases including retail sales and the performance of several banks at the start of the sector’s reporting season.

Asia markets were also under pressure after China’s trade figures showed the continued impact of Covid-19 outbreaks on activity.

Imports rose by 19.5% year-on-year in December, which was well short of market expectations and down on the big rise of 31.7% seen in November.

Despite the disappointing figures on Chinese demand, the price of Brent crude remained near to $85 a barrel having rallied in previous sessions.

Source link