Royal Mail is handing £400m to shareholders after its parcel delivery business benefited from the greater shift to online spending during the pandemic.

The accelerated trend to more parcels, which Royal Mail said was a permanent shift, helped it to a £311m pre-tax profit in the six months to 26 September, after barely scraping a profit last year. Its revenues rose by 7% year-on-year to £6.1bn.

The news sent shares up 5% on Thursday morning, making Royal Mail the top riser on the FTSE 100.

It marks a turnaround in fortunes for the company, after the early pandemic lockdowns depressed Royal Mail’s profits as it added new costs and hit the volumes of letters sent. However, the delivery company said it has seen a “structural shift” in parcels, with volumes up by a third during the financial half year compared with before the pandemic – although they were down by 4% compared with 2020, when customers were locked down at home and non-essential shops were closed.

The company, which was privatised controversially in 2013, has struggled with what it described as the “structural decline” of letters as more people use email for official purposes, with revenues from parcels only overtaking letters for the first time a year ago. It delivered more letters between April and September than the equivalent last year, but still a fifth less than in 2019.

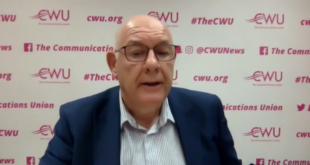

At the same time Royal Mail has been restructuring. A new management team has brought in an agreement with the Communication Workers Union after a breakdown in the relationship under former chief executive Rico Back and cuts to 2,000 management jobs in June 2020.

The strong financial recovery has allowed Royal Mail to give shareholders money, despite its ongoing investments in automation to make it more efficient and efforts to make £110m in costs savings. It said on Thursday it would return £400m via a £200m share buyback that will start immediately and a £200m special dividend. It will also pay a £67m interim dividend.

Keith Williams, Royal Mail’s non-executive chair, insisted the company would be able to fund investment in new technology and growth from future cash flows, justifying the shareholder returns. It comes ahead of the crucial Christmas period after the company failed to cope with parcel volumes last year.

Royal Mail has also been pushing to weaken some of the “universal service” requirements imposed on it as a former state-run service, including removing the obligation to deliver post on Saturdays. Simon Thompson, Royal Mail’s chief executive, hinted further that it would push this agenda, saying the company needs to “start defining what a sustainable universal service is for the future”.

Source link