Royal Mail (LSE: RMG) shares have had a good run recently. I’ve written about the stock before when I wasn’t convinced by the investment case. But that was then. Now I’ve had another look at the shares and I think the company is at an inflection point.

Would I buy the stock now? Yes, for a few reasons.

Parcels galore

I’ve previously mentioned this, but I think it’s worth highlighting again. Parcels revenue has now overtaken letters revenue. This isn’t a surprise to me. One of the reasons why Royal Mail shares have performed well is the rise in online shopping during the pandemic.

Let me be frank, not many people send letters anymore. For plenty of us, it’s all done electronically. I reckon Royal Mail’s letters revenue is in a secular decline. The coronavirus lockdowns have resulted in an increase in parcel deliveries and I expect this trend to continue well into the foreseeable future.

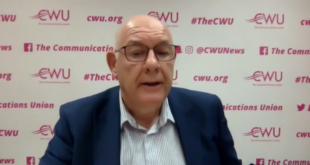

Staff and union members

The reaction of the unionised workforce has been the main reason why I’ve changed my view on Royal Mail shares.

In my opinion, the stock has lagged somewhat due to the difficulties of getting the workforce to accept change. But in December, the company reached a landmark agreement with staff and union members. And earlier this month, Royal Mail announced that its workforce had now voted “overwhelmingly in favour” of the deal.

So after this vote, why would I buy Royal Mail shares? Yes. It seems both sides are happy. The Communications Workers Union (CWU) called it a “landmark” deal that offers better conditions for postal workers and job security. In return, workers have acknowledged the need to focus on swifter change. That means using technology to improve customer service and efficiency. They’ve also agreed to start building out the infrastructure needed to improve the parcels network.

I think this is all positive news for Royal Mail shares. While ongoing disputes between management and the workforce were hindering the company from growing, the deal changes all that. To me, this is a huge step in the right direction.

Risks

Let me highlight that implementing change across Royal Mail will take time. I recognise that any delays could set back progress, which may impact the shares.

And the pandemic has increased the volume of parcel deliveries, but there’s no guarantee this trend will continue after Covid-19. Improving infrastructure will cost the business and may impact future profitability. Especially if growth in parcels fails to deliver.

GLS unit

I think Royal Mail’s small international parcel operation, General Logistic Systems (GLS) is the jewel in the crown of the business. This division has been growing rapidly and is on target to deliver full-year revenue growth at the top end of the 21%-23% range. I think this is impressive and it highlights the importance of this business to the future of the company.

I believe Royal Mail has a decent shot at growing and resolving its legacy issues. This is why I’d buy the shares now. It’s due to report its full year 2020/21 results on May 20. Given how good last year was for the company, I reckon Royal Mail could even reinstate its dividend.

Nadia Yaqub has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.